Archive for category Finance

Najib throws more election goodies

Posted by Kit in Elections, Finance, Najib Razak on Tuesday, 26 March 2013

Anisah Shukri| March 25, 2013

Free Malaysia Today

The prime minister announces four changes to the 40,000 staff of seven statutory bodies ahead of the polls.

KUALA LUMPUR: Prime Minister Najib Tun Razak today announced sweeping benefits for the 40,000 staff of seven government statutory bodies, ahead of the general election which must be held within weeks.

The benefits to be given to LTAT (Lembaga Tabung Angkatan Tentera), LHDN (Lembaga Hasil Dalam Negeri), EPF (Employees Provident Fund), Tabung Haji, Perkeso, Perhebat (Armed Forces Veteran Affairs Corporation), and Bank Simpanan Nasional are:

*a pension fund set up for all personnel;

*fixed housing allowances equivalent to that of civil servants;

*gratituities for retirees; and

*streamlining employer contribution towards the EPF.

The benefits come in the wake of Najib’s announcement yesterday that the government would award 10,000 individual permits to taxi drivers, in what can be seen as a last-minute attempt to woo voters before polls are held.

Read the rest of this entry »

Is your pocket 41 percent deeper?

Aidila Razak

Malaysiakini

Mar 23, 2013

COMMENT

Whether 41 percent or 49 percent, the numbers in the Economic Transformation Programme 2012 annual report is essentially trying to tell us this – Malaysia will reach high income status by 2020.

That gives the impression that the average Malaysian will be bringing home about RM48,000 (or US$15,000) a year by that time.

But will they? Does the average Malaysian feel 41 percent – or even the more modest 24 percent in ringgit terms – richer today compared to 2009? Are their pockets deeper?

The simple answer is no.

So is the government lying to us? Not exactly. Read the rest of this entry »

26-Day Countdown to 13GE – Federal Government Deficits and Debts

Posted by Kit in Economics, Elections, Finance, Najib Razak on Saturday, 16 March 2013

Unlike many developing countries, Malaysia had until the last 15 years, avoided deficit funding and the accumulation of high levels of external and internal debt that culminated in debt crises of the type that afflicted Argentina, Mexico and many countries in Sub-Saharan Africa.

The Federal Government followed prudent policies and followed fiscal policies that were viewed favorably. Both Foreign Direct Investment flows and the domestic private sector contributed to growth.

Thus, through the early 1970s and the decade of the 1980s small deficits were recorded, indeed in the early 1990s small surpluses were recorded. The size of the public debt was largely stable and did not exceed RM 100 billion.

However, the 1997 East Asia crisis, triggered by contagion effects of the crisis in Thailand, led to a radical change in fiscal policy. The Federal Government embarked on a pump priming effort to revive the economy.

Many large scale projects were mounted; many heavily indebted crony corporations were bailed out. The public sector surplus of RM 6.6 billion recorded in 1997 evaporated and became a deficit of RM 5 billion in 1998.

Since 1998, despite the recovery, the Barisan Nasional (BN) Government has continued to run deficits ever increasing deficits which peaked under the Prime Ministership of Datuk Seri Najib to RM 47 billion. Read the rest of this entry »

27-Day Countdown to 13GE – IMF Report Card warns of an austerity scenario for Malaysian economy not too dissimilar to that of several EuroZone countries

The nation is just weeks away from choosing a Government to steer the ship of state.

The upcoming General Election will be momentous and will demand a choice between Barisan Nasional, a coalition that has ruled the nation for almost five and a half decades, and Pakatan Rakyat, an alternate group that offers change and a new direction.

Meaningful choices should ideally be based on full information about the current state of affairs and the alternative visions offered by the two coalitions.

The information on the state of the economy is less than transparent and that which is available is skewed in favour of the incumbent regime. The opposing coalition lacks full access to information.

Under these circumstances, it is necessary to look to alternative independent sources to arrive at objective assessments.

Such an objective and comprehensive assessment is indeed available. The International Monetary Fund (IMF) conducted its Annual Article IV Consultations in Nov –Dec 2012. A report based on the consultations was considered by the IMF’s Board of Executive Directors in late February 2013. The Fund has released the report and posted it on its website. Read the rest of this entry »

28-Day Countdown to 13GE – Najib’s “Alice-in-Wonderland Statistics in his Transformational Malaysian Economy”

Posted by Kit in Economics, Finance, General, Najib Razak on Thursday, 14 March 2013

I have received an email from a retired international banker from the Malaysian Diaspora, who describes himself as a “Fact-Finder” monitoring the Malaysian economy, sharing his outrage on what he described as Prime Minister Datuk Seri Najib Razak’s “Alice-in-Wonderland Statistics in his Transformational Malaysian Economics” in his hour-long television interview on Tuesday.

I find this email so interesting, perceptive and pertinent that I am reproducing it in full, viz:

” Misuse of Data

The Prime Minister cut a rather sorry figure in his appearance on TV3’s programme entitled ‘Conversation with the PM’ aired on March 12th.

His remarks were a disappointment as he indulged in delivering clichés and ‘feel good’ statements concerning the state of the economy. He missed an opportunity to present a clear a vision of what he stands for. Read the rest of this entry »

Malaysian government’s debt to approach RM1 trillion by 2020

by Pak Sako | Monday, 25 February 2013 14:53

CPI

CPI Introduction

This is the second part of a three-part CPI series on Malaysian debt. The first part, entitled, ‘Investigate Malaysia’s debts now’ , surveyed the overall debt situation.

This part examines the trend in government debt. The upcoming part will concern Malaysia’s total debt.

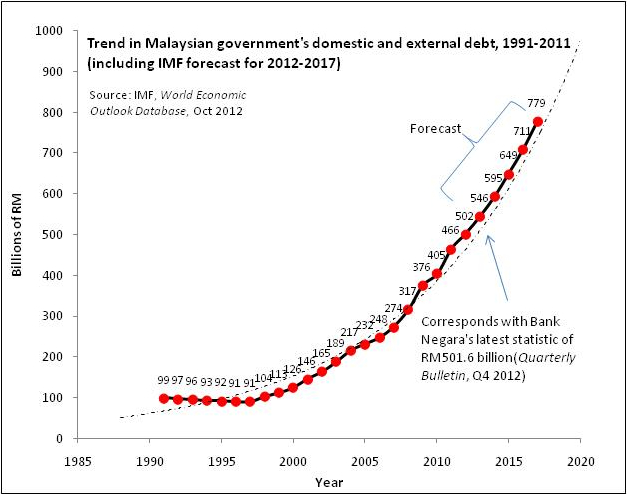

Statistics reveal that in the last 15 years, the Malaysian government’s debt increased at an unprecedented rate.

The graph below shows the statistics for the government’s combined domestic and foreign debts from 1991 till the present. Forecasts are provided up to the year 2017.

Room for competent Bumiputera companies: How to become competitive

— Koon Yew Yin

The Malaysian Insider

Feb 24, 2013

FEB 24 — After reading the article “Room for Competitive Bumiputera Companies’ in The Edge this morning, I am encouraged to write this piece to support Petronas Chairman Tan Sri Shamsul Azhar Abbas.

He said that in 2010 and 2011 alone Petronas awarded about Rm 74 billion worth of contracts to Bumiputera controlled companies, a sum cannot be described as anything but huge.

Despite this Petronas has become a punching bag for Malay right wing and business groups in recent months. The Malay Economic Action Council (MTEM)- an umbrella of more than 60 business group blamed Petronas for sidelineling Bumiputera companies and favouring more competitive foreign companies.

The MTEM has called for Tan Sri Shamsul and the Menbers of the Board of Petronas to resign. This is outrageous. The Malays cannot continue to expect hand outs and juicy contracts.

It is time they must realise that they have to become more efficient and competitive to face the real business world. Read the rest of this entry »

Investigate Malaysia’s debts now

Posted by Kit in Economics, Finance, Financial Scandals, Mahathir on Saturday, 23 February 2013

By Pak Sako | Thursday, 21 February 2013 11:34

CPIASIA

Former prime minister Mahathir Mohamad claimed last week that Malaysia’s current debt level is “healthy” compared with Greece’s.

But the debt-to-GDP percentage Mahathir relied on tells next to nothing about the full extent of Malaysia’s debts; the nature of these debts; or what can happen next.

The real devil lies in the details, namely:

(i) the trend in the debt level.

How has it changed in the recent past? Is there momentum in a certain direction? The federal government’s debt had doubled in just four years from 2007 and 2012. Will it stop growing, or will the trend and absolute totals continue their upward rise?

In the last decade, our finance ministers have repeatedly pledged to reduce the budget deficits. This has not happened. Instead, deficits have ballooned and the federal government’s debt has mounted.

(ii) the causes of debt.

For what are the borrowings and for whom? Are these borrowings for worthwhile investments that benefit the public? Are these liabilities being used to cover government operating costs or to prop up failing crony companies or the stock market? Is the use of costly loans for projects with low or no rates of return justified?

Almost a trillion ringgit was recently whisked out of the country in the form of illegal outflows. This is capital flight. It is conclusive evidence that our economy is ‘leaking out’ wealth.

Read the rest of this entry »

Star Headlines (07/02/13) “150k loans for students”

Posted by Kit in Education, Finance, Najib Razak on Friday, 8 February 2013

By PW Cheng

Feb 7, 2013

I would like to remind those students and parents who had read the Star today (07/02/2013) on “150k loans for students”, do not feel ecstatic about it. Please be prepared for a rude shock. No banks or any financial institutions in their right mind will give loans without any collateral. As according to Najib “this is a creative way of helping the rakyat”, I do not see anything creative about this. The interests charged is far too high and much higher if you were to take a mortgage loan. Najib should be sent back to school to study mathematics and calling it as creative, do not emanate intelligence.

In 2004 or 2005, the government has a loan scheme for tertiary students studying overseas. I was one of the few who knows about this loan scheme. Not even Dr Wee Ka Siong ( who was then the MCA Education Bureau chief) knows about this. I tried applying the loan for my son who was studying in Australia then but PSD kept on giving various excuses by twisting their terms and conditions to turn the loan down. Read the rest of this entry »

What change? A reply to Dr M

― Pak Sako

CPI

Jan 04, 2013

JAN 4 ― Former prime minister Dr Mahathir Mohamad published a piece called “Change” yesterday in his blog.

In it he asked why change governments.

He then criticised the socialist ideology. He strangely claimed that “Malaysia has no ideology”.

That is completely untrue.

When Dr Mahathir came into power in 1981, Malaysia was introduced to the neoliberal ideology.

This is an ideology that is biased in favour of corporations and capitalists.

It is the opposite of socialism, which aspires to put people first.

The neoliberal ideology was aggressively promoted around the world in the early 1980s by influential global networks of business interests and their supporters.

Their mantra? Read the rest of this entry »

Let 2013 end the national deformations and usher in an era of genuine national transformation by electing a new Pakatan Rakyat Malaysian government for the first time in 55 years

Posted by Kit in Corruption, Education, Elections, Finance on Monday, 31 December 2012

For nearly four years, Prime Minister Datuk Seri Najib Razak had been promising one transformation programme after another – government, economic, political, educational, social, etc all under an overarching slogan of 1Malaysia under one agency or another.

All these pronouncements and initiatives have achieved is to earn the nation the epithet of “The Acronym Nation” while national deformations in all aspects of national life have proceeded unchecked.

Najib’s four-year premiership will be remembered by Malaysians as an administration of plunging global indices, and this unpleasant fact has been underlined by three international reports in the last month of this year, viz: Read the rest of this entry »

Before meddling with subsidies, ask why we need subsidies

Posted by Kit in Economics, Finance, Public policy on Friday, 26 October 2012

by Pak Sako

26th Oct 2012

Two groups, CPI and REFSA-IDEAS, are debating government subsidies.

This debate is critical because politicians are taking their cues from it.

It is important that good judgement prevails. Much is at stake.

But first, what is a subsidy? Why do we need it?

Some believe subsidies are government money spent on primary healthcare, infrastructure, culture or the environment.

But these are not subsidies. These are fundamental public provisions that a decent society would collectively provide for all its members in most ordinary circumstances.

A subsidy is different. It is a special kind of public expenditure.

A subsidy is designed to support a disadvantaged group that cannot secure the needs and necessities for survival because an underlying condition is persistently preventing their fulfillment. Read the rest of this entry »

Refsa on subsidies: Still off the mark

Posted by Kit in Economics, Finance, Lim Teck Ghee on Thursday, 25 October 2012

Dr Lim Teck Ghee

CPI

The response by Research for Social Advancement (Refsa) institute to my note is disappointing. It provides little value added to the current knowledge on subsidies in Malaysia; repeats various motherhood statements about the need to rein in subsidies and selectively focuses on so-called various ivory tower statements that they have detected in my note to triumphantly declare victory.

The major contention in my note is necessary to repeat:

It is necessary to remind the REFSA-IDEAS team that subsidies have an important role to play in providing a safety net for vulnerable groups. They help bring down the cost of living as well as enable access to health, education, transport and other necessities.

They are a necessary burden in a highly skewed capitalist economy such as Malaysia’s where the lower classes of labour do not get the fair remuneration that they are entitled to or deserve. Read the rest of this entry »

Dr M defends policies, says Jews created problems

Posted by Kit in Anwar Ibrahim, Finance, Mahathir, nation building on Tuesday, 23 October 2012

By Zurairi AR

The Malaysian Insider

Oct 23, 2012

KUALA LUMPUR, Oct 23 — Tun Dr Mahathir Mohamad today blamed Jews for “creating problems for us,” and pointed out that while his economic policies may have been interpreted as anti-Semitic it was actually to help develop Malaysia.

This morning, former Cabinet minister Tan Sri Sanusi Junid said Dr Mahathir’s policies when he was prime minister were inspired by Germany’s past policy of limiting Jewish financial influence to help the Malays but they were later thwarted by Datuk Seri Anwar Ibrahim.

Sanusi told a Malay economic forum that Dr Mahathir and former Finance Minister Tun Daim Zainuddin were hoping that Malays would control the economy but when they saw progress was slow, they decided to follow the German example of not granting banking licences to Jews, in their treatment of Chinese interests.

“The problem is that they (Jews) were the ones who created problems for us and the world because they disobeyed international law and got away with it,” Dr M said in a press conference this afternoon.

He also pointed out that he won the general election in 1999 because non-Malays supported him, while Malays refused to since they thought his treatment of Anwar was unfair. Read the rest of this entry »

The 2013 Budget: Najib’s Last Hurrah? (1)

Posted by Kit in Budget Debate, Finance on Wednesday, 3 October 2012

“More debt has been accumulated in six years than what took 48 years after Merdeka to accumulate.”

A Brief History

The Budget unveiled by the Prime Minister on September 28th , his fourth budget, contained no real surprises. It followed the broad pattern of previous Budgets presented since 1998, the year of the East Asian Financial crisis.

A constant feature of these Budgets has been the use of deficit financing to further the BN agenda of promoting the interest of its key constituents while maintaining a grip on the loyalty of its traditional supporters. Tax giveaways and subsidies were part of the instruments used.

Despite buoyant revenues from the exploitation of natural resources which provided almost a third of revenue, the Government has consistently ran deficits which contributed to the buildup of a mountain of debt. The initial rationale for deficit financing was to stimulate and revive the economy after the devastating set back resulting from the East Asia Financial crisis of 1998. Read the rest of this entry »

Budget 2013: Same old formula, with no solutions

Posted by Kit in Budget Debate, Finance on Sunday, 30 September 2012

Tony Pua

MP SPEAKS

Malaysiakini

Sep 28, 2012

Over the past few years, the government has been able to increase its budget tremendously to achieve record expenditures annually.

This has allowed the government to prop up the economy as we face challenges in attracting private investments, as well as a drop in our trade contributions.

However, Budget 2013 has projected an increase of only 0.7 percent (2012: 11.8 percent; 2011: 16.1 percent) in projected revenues from RM207.2 billion to RM208.6 billion in 2013.

This is the slowest projected increase in the tabled budget since 1999, barring the global financial crisis in 2009.

Consequently, the government is forced to table a smaller budget than the prior year. The proposed operating expenditure has been reduced by 0.3 percent from RM202.6 billion to RM201.9 billion, while the development expenditure is also reduced from RM46.9 billion to RM46.7 billion or 0.4 percent.

The marked decline in revenue growth will have a very significant impact on the government’s ability to impact growth in the Malaysian economy through fiscal means.

The fact that we have not been able to reduce our budget deficit below four percent over the past few years reflects the years of wasted opportunities, where we have failed to curb our expenditure through reduced wastage, abuses and corruption. Read the rest of this entry »

Is Malaysia’s IPO Boom Overhyped?

– By Dhara Ranasinghe

CNBC

27 Aug 2012

Malaysia is marking itself out as the IPO destination to beat this year with a string of billion-dollar-plus deals. Impressive, for sure, but don’t take the booming IPO market as a sign that Malaysia is poised to become a regional financial hub, experts say.

The reasons for this, they add, are simple: once the slew of big Malaysian companies seeking new listings runs out there is likely to be a dearth of initial public offerings (IPOs) in Malaysia. Because Malaysia is still developing open and liquid capital markets, foreign firms looking to list in the region are likely to pick Singapore and Hong Kong over Kuala Lumpur.

All the big companies listed in Malaysia this year are local firms. To really develop itself as a centre for IPOs, Malaysia needs to attract new listings from big foreign firms in the way Singapore and Hong Kong have done in the past, analysts add.

“Part of the boom in the Malaysian IPO market can be explained by the well-developed pension system in Malaysia, which has allowed for growth in domestic demand for equities,” said Herald Van Der Linde, Head of Equity Strategy, Asia-Pacific at HSBC in Hong Kong.

“However, when it comes to comparing Malaysia with Singapore and Hong Kong, these markets are much larger, more diversified and much better developed. As such, they can compete for global IPOs. This is unlikely to happen in Malaysia yet,” Van Der Linde said. Read the rest of this entry »

Be aware of Fitch’s fiscal warning

— Ramon Navaratnam

The Malaysian Insider

Aug 23, 2012

AUG 23 — International ratings agency Fitch Ratings has once again warned Malaysia that its public finances are under sustained strain!

This firm but polite expression of censure, if not admonition, should not be played down by unduly highlighting Malaysia’s short-term good economic growth gains in the last two quarters of this year .

Neither should we be complacent about the serious declines in economic growth and stability occurring currently in the relatively rich developed industrial world. We can do this only at our own peril.

The fact of the matter is that Malaysia will be adversely affected by the global slowdown in the near future. The extent of our economic slide is difficult to project at this time. But we know for sure that we cannot take a “business as usual” attitude against the headwinds and strong disruptive socio-economic currents whirling around us, at home and from abroad. Read the rest of this entry »

Ideology and debt: A reply to Dr Mahathir

— Pak Sako

The Malaysian Insider

Aug 23, 2012

AUG 23 — In his blog post “Change” (August 22, 2012), former Prime Minister Tun Dr Mahathir Mohamad criticised the socialist ideology.

He then claimed that “Malaysia has no ideology”.

This is not accurate.

It can be strongly argued that the Malaysian government after 1980 followed the “neoliberalism” ideology, a pro-business ideology.

This economic ideology was aggressively promoted around the world at the start of the 1980s by two pro-business world leaders: British Prime Minister Margaret Thatcher (elected 1979) and American President Ronald Reagan (elected 1981). Read the rest of this entry »

Mounting Malaysian debt could lead to downgrade, says ratings agency

By Lee Wei Lian

The Malaysian Insider

Aug 01, 2012

KUALA LUMPUR, August 1 — Malaysia’s public finances are weak relative to those of its ‘A’ range peers and the country is now on par with more heavily indebted ‘A’ range sovereigns such as Italy, said Fitch Ratings today.

This comes after some economists said that the federal government’s debt, which nearly doubled since 2007 to RM421 billion, poses a fiscal risk to the country if not managed carefully as it impairs Malaysia’s resilience to economic shocks, which appear to be occurring with increasing frequency.

Fitch said that despite strong GDP growth, the deterioration in public debt ratios is affecting Malaysia’s credit profile and a lack of progress on fiscal reforms could lead to a ratings downgrade.

Fitch said that the rise in the federal government debt-to-GDP ratio and the limited broadening of the fiscal revenue base have pushed Malaysia’s debt-to-revenue ratio to 246 per cent in 2011, which is well above the ‘A’ and ‘BBB’ range medians of 137 per cent and 119 per cent respectively and is now on par with more heavily indebted ‘A’ range sovereigns such as Italy at 261 per cent and Israel at 180 per cent.

Italy is considered one of the countries at risk of a debt default and saw its borrowing costs soar to above seven per cent in November last year. Read the rest of this entry »