Archive for category Economics

Asia’s Dangerous Strongman Nostalgia

By William Pesek

Bloomberg

Feb 4, 2014

Indonesia is growing at 6 percent, has rejoined the ranks of investment-grade nations, and after decades under the corrupt and repressive Suharto, has reaffirmed its place as the world’s third-largest democracy. Yet somehow enough Indonesians remember the Suharto years fondly that his Golkar Party has hopes of regaining power in upcoming elections.

Golkar isn’t alone in trying to exploit nostalgia for past strongmen (and -women). India’s Congress Party is trying to squeeze any remaining good feelings about the Nehru-Gandhi period (from 1947 to about 1989) to elevate lackluster heir apparent Rahul Gandhi. Even as China’s Xi Jinping pushes ahead with market reforms, he continues to pay homage to Communist icon Mao Zedong (1949-1976). Thais are destroying their economy rather than cut off support for tycoon Thaksin Shinawatra (2001-2006) and his sister Yingluck. Many Malaysians wax sentimental about the boom days of Mahathir Mohamad (1981-2003). Japanese are indulging Shinzo Abe’s dangerous stroll down memory lane.

What gives with nostalgianomics? The yearning for yesteryear speaks to our disorienting times and a dearth of visionary leadership when it’s most needed. This is an upside-down era when the unthinkable has a way of becoming reality: The U.S. is a developing nation again; Europe is hitting up “poor” China to bail out its debt markets; central banks have gone Islamic with zero-interest rates everywhere; the free trade that once raised living standards now foments poverty. Many simply want to get off this crazy ride. Read the rest of this entry »

Tolls and hikes short-circuiting Malaysian future

S RAMAKRISHNAN | 12:47PM Jan 2, 2014

Malaysiakini

COMMENT The simultaneous increase in fuel and sugar prices, electricity tariff and toll hikes have got Malaysians worried and bewildered as to how they will manage their household expenses. Compounding matters will be the Goods and Services Tax (GST) that will kick in in 2015. The already weakened ringgit and the sudden withdrawal of subsidies on essential goods will hit hard where it hurts most – the pocket.

Not unlike Marie Antoinette, the prime minister is obstinately insisting that the people can afford these massive hikes. Talk about telling the masses to eat cake, he adds insult to injury by saying these increase are not a burden!

Not unlike Marie Antoinette, the prime minister is obstinately insisting that the people can afford these massive hikes. Talk about telling the masses to eat cake, he adds insult to injury by saying these increase are not a burden!

The entire cabinet and prime minister suddenly woke up from their slumber. It dawned on them that the budget deficit, huge public and household debt have to be narrowed. What is shocking is that for 16 continuous years, the deficit and the mounting debt did not raise any alarm bells.

In fact the pro-government economists and mainstream media stoically reminded the rakyat that economic fundamentals were positive and our country is on track to become a developed nation by 2020. But all that propaganda did not convince the world. Fitch Rating Agency, in a startling report, downgraded Malaysia from stable to negative. And the game was up.

The media propaganda failed and even more frightening, instead of being developed Malaysia, by 2020, may be a bankrupt nation!

The acrimonious Fitch report had a jolting effect that aroused the Malaysian government from its deep slumber and self-delusion. It suddenly dawned upon the cabinet that the lies they had believed to be the truth, were, in fact, lies. Read the rest of this entry »

10,000 defy warning, police give in to protesters

Posted by Kit in Economics, Najib Razak, Police, Prices on Wednesday, 1 January 2014

Malaysiakini

7:40PM Dec 31, 2013

In anticipation of a gloomy 2014, demonstrators took to the streets in Kuala Lumpur tonight to protest the rising cost of living as a result of the government’s austerity measures.

The New Year’s Eve protest, organised by a coalition of NGOs led by Gerakan Turun Kos Sara Hidup (Turun), saw participants gathering at three meeting points – Sogo Shopping Complex at Jalan Tuanku Abdul Rahman, Pasar Seni and Masjid Jamek

They then marched to Dataran DBKL before proceeding to the adjacent Dataran Merdeka where the Kuala Lumpur City Hall is organising a New Year’s concert.

They then marched to Dataran DBKL before proceeding to the adjacent Dataran Merdeka where the Kuala Lumpur City Hall is organising a New Year’s concert.

The authorities have accused protest organisers of planning to overthrow the government and police have branded the rally “illegal”.

Police claim to have intelligence that dangerous weapons and bombs will be present at the demonstration but protest organisers have vehemently denied this.

Turun chief Mohd Azan Safar said the government was attempting to distract attention from the cost of living issues, which is the focus of the protest.

LIVE REPORTS

1.00am – This conclude our LIVE coverage of the rally. And no, the federal government has not been toppled. Happy New Year.

12.15am, Dataran Merdeka – Addressing the crowd, Turun chief Azan Safar leads the protesters to pledge for a corruption free 2014, while Solidarity Anak Muda Malaysia (SAMM) chief Badrul Hisham Shaharin later takes over the microphone and asked: “Was there any violence? Was there any bombings?”

He then leads the protesters in a comedic song which contains the lyrics “We love the police and the police loves us… We are only just upset that BN cheated us because they said toll will go down, but instead it went up”.

He then leads the protesters in a comedic song which contains the lyrics “We love the police and the police loves us… We are only just upset that BN cheated us because they said toll will go down, but instead it went up”.

Read the rest of this entry »

Power tariff – the last straw that broke the camel’s back?

Liew Chin Tong

Malaysiakini

Dec 6, 2013

MP SPEAKS

The spate of new taxes and price hikes, the latest being the electricity tariff hike, have caused me to doubt whether the government under Najib Abdul Razak has any idea about the macroeconomic risks that Malaysia faces.

Against the backdrop of an uncertain global economy and the likeliness of the quantitative easing tapering, domestic demand is crucial in sustaining the Malaysian economy. Yet the spate of new taxes and price hikes will produce an opposite result: the further decline of domestic demand.

Will the electricity tariff increase become the last straw on the camel’s back that will see the Malaysian economy collapsing due to the confluence of several domestic and global factors?

The electricity tariff will be increased by an average of about 14.89 percent for Peninsular Malaysia, and by about 17 percent for Sabah and Labuan from next year.

The average electricity tariff in Peninsular Malaysia will be up 4.99 sen per kWh or 14.89 percent from the current average rate of 33.54 sen/kWh to 38.53 sen/kWh.

For Sabah and Labuan, the average tariff will be up 5 sen per kWh or 16.9 percent from current average rate of 29.52 sen per kWh to 34.52 sen per kWh. Read the rest of this entry »

The Economic Reality of Malaysia Today

A speech by Y.B.M. Tengku Razaleigh Hamzah

The Perak Academy, Perak Lectures in Ipoh: 15th Series 2nd Talk

Saturday, 23rd November, 2013, at 8.00 p.m.

Chairman,

Ladies and Gentlemen.

I would like to thank the Academy for inviting me a second time to give a talk on the current state of the economy. After the presentation of Budget 2014 in Parliament last month and the ongoing debate in the august house, the state of the economy is indeed a relevant question to ask. Economic reality however may not be what it is made out to be when one engages in political debate in respect of the Budget: often it is the unstated issues in the Budget and its underlying strategies and proposals that should be of great concern to thinking Malaysians.

Ladies and Gentlemen,

2. The Budget 2014 projects that GDP growth rate next year will likely be around 4.5 to 5% and 5.5% in 2015. These figures had remained in that range for the past budgets since 2000, reflecting some kind of paralysis of policy given the global economic situation and our own model of growth that depends so much on our external markets and the optimism of foreign interests in our economy. But, these figures conceal some forewarnings that are not highlighted.

3. Take for instance, the budget deficits, which had remained in negative territory for over twenty years; now the Najib government has promised to bring the budget into balance by 2020. The federal deficit has been sustained by borrowings that are now reaching close to the statutory debt ceiling of 55% of GDP. In fact the federal debt levels in absolute terms doubled since Dato’ Seri Najib took over as Prime Minister. Coupled with private debt currently at 83% of GDP (an issue I will come back to later), the total debt exposure which will have to be carried over into the next generation will now approach 140% of GDP at current prices by the end of the year. Read the rest of this entry »

Moody’s has given us a good mood… but is it sustainable?

Posted by Kit in Economics, Finance, Najib Razak on Friday, 22 November 2013

– Ramon Navaratnam

The Malaysian Insider

November 21, 2013

After the earlier cautious Fitch Rating Report on Malaysia’s sovereign credit outlook, the Moody’s Investors Service’s upgrading of our credit outlook from “stable to positive”, uplifts our mood on our country’s economic prospects.

Yes Moody’s has given us a good mood on our economic prospects. But unfortunately the question lingers as to whether this feel good mood, about our sovereign credit and economic outlook, can be sustained and for how long?

The upgrading had been due to the positive and bold promises made in Budget 2014 Speech by Dato Seri Najib Tun Razak. His speech has obviously made an impact on Moody’s. Read the rest of this entry »

Racism and inequality

Posted by Kit in 1Malaysia, Economics, Najib Razak, nation building on Monday, 18 November 2013

Sakmongkol AK47 | NOVEMBER 17, 2013

The Malaysian Insider

Government leaders preach inclusiveness and togetherness. At the very least they pretend to want that. The idea of togetherness and inclusiveness can be summed up in the powerful idea of unity.

Something of that nature cannot be sold like an advertising product and commoditised- it must be secured by living out that experience. It must be practised as an everyday life experience.

Something of that nature too must be formed on the basis of earning and giving trust. The government has neither earned our trust and they have never trusted the people.

PM Najib paid a lot of money to consulting firms to come up with slogans to reflect the idea. He has actually paid RM7.2 billion to a number of consultants since 2009. Over a 5 year period, the fee is like RM3.945 million a day.

We won’t know how much PM Najib paid consultants who came out with slogans and follow through plans of 1Malaysia and now Endless Possibilities. What seems truly endless is the rapacious appetite to gobble up taxpayers’ money.

Read the rest of this entry »

Business confidence in local economy dropping, survey shows

The Malaysian Insider

November 07, 2013

Business confidence in Malaysia plummeted in the third quarter of this year as the post-election boost has vanished, according to the Global Economic Condition Survey.

In a statement issued today, the Association of Chartered Certified Accountants (ACCA) and the Institute of Management Accountants (IMA) said the survey revealed that 65% of the respondents believed conditions in the Malaysian economy were stagnating in the third quarter of this year.

This is an increase from the 55% of respondents who felt business conditions in Malaysia were deteriorating or stagnating in the second quarter of the year. Only 13% of businesses reported confidence gains in the third quarter, down from 28% in the second quarter. Read the rest of this entry »

A critique of the 2014 Budget Speech

Posted by Kit in Budget Debate, Economics, Finance on Tuesday, 5 November 2013

by Budget analyst

A careful analysis of the 2014 Budget Speech by the Prime Minister-cum-Finance Minister, Datuk Seri Najib Razak is most revealing and disappointing as there is little by way of an exposition of the challenges the economy faces.

The customary presentation of data on the performance, in the current year and prospects in the year ahead, are matters that are dismissed in a few perfunctory sentences.

The speech gives little information on basic macro-economic assumptions used in basing the revenue and expenditure forecasts that make up the Budget.

The speech gives no hint of how the Government proposes to deal with the less than robust external environment in which the key Malaysian export markets – China, US, the EURO zone – will continue to record sluggish demand.

The price for Malaysian oil and gas are likely to be weaker because of increasing supply from US shale oil and the re-entry of Iranian oil into global markets. With greater supply and lower demand, prices are likely to be lower. Malaysian oil and gas exports will undoubtedly feel the impact. Read the rest of this entry »

GST: killing the golden goose

Posted by Kit in Budget Debate, Economics, Finance on Saturday, 26 October 2013

– Liew Chin Tong

MP for Kluang

The Malaysian Insider

October 25, 2013

The proposed goods and services tax (GST) will tax those who can’t afford to be taxed, i.e. 60% of Malaysians who are eligible for BR1M. These are the people who will soon be taxed by the regressive tax, together with the rest of us who live and stay in this country.

I would like to drop the Orwellian double speak so prevalently employed by many GST apologists who are trying to mask the real issue. I will share my views plainly here.

Flawed arguments

Some argue that the government has to be cruel to be kind. Hence, BN would have us believe that the fuel hike subsidy rationalisation is needed to balance the government’s expenditure and ensure its good financial standing.

In theory, this sounds legit. However, look closer and you will find many flaws in the argument. For one, this argument does not take into account the adverse effects on the man on the street. It also demonstrates an incomplete understanding of how the economy grows or declines.

What is the real reason for the Barisan Nasional government to implement the GST? This tax has hung like a sword of Damocles over our heads since Tun Abdullah Ahmad Badawi’s era in 2005. Read the rest of this entry »

Berapakan jumlah nilai ekuiti yang diperuntukkan untuk Bumiputera, nilai yang masih dalam pegangan dan bagaimana boleh membantu rakyat Bumiputera biasa?

Posted by Kit in Economics, Parliament on Thursday, 24 October 2013

PERTANYAAN DEWAN RAKYAT

TUAN LIM KIT SIANG minta PERDANA MENTERI menyatakan berapakah jumlah nilai ekuiti yang diperuntukkan untuk Bumiputera setakat hari ini, nilai yang masih tinggal dalam tangan Bumiputera, dan bagaimana program sedemikian boleh membantu rakyat Bumiputera biasa.

JAWAPAN: YB SENATOR DATO’ SRI ABDUL WAHID OMAR. MENTERI DI JABATAN PERDANA MENTERI

Tuan Yang di-Pertua,

Untuk makluman Ahli Yang Berhormat, Kerajaan telah menggunakan beberapa pendekatan untuk meningkatkan pemilikan ekuiti Bumiputera. Antara lain, termasuk peruntukan saham khas kepada Bumiputera bagi syarikat yang akan disenaraikan di Bursa Malaysia, lanya dilaksanakan oleh Kementerian Perdagangan Antarabangsa dan Industri (MITI). Ringkasan penyertaan Bumiputera dalam pasaran saham melalui peruntukan saham khas ini adalah seperti dalam jadual di bawah:

| TAHUN | JUMLAH TAWARAN SAHAM KHAS (UNIT) | NILAI (RM) | TAWARAN KESELURUHAN IPO (UNIT) | PERATUSAN TAWARAN SAHAM KHAS BUMIPUTERA (%) |

|---|---|---|---|---|

| 2013* | 1,204,717,700 | 2,324,592,915 | 17,146,814,329 | 7.0 |

| 2012 | 1,552,878,400 | 5,127,533,410 | 7,537,722,900 | 20.6 |

| 2011 | 826,612,300 | 1,913,479,398 | 5,640,376,813 | 14.7 |

| 2010 | 1,505,157,900 | 5,918,993,850 | 7,892,390,280 | 19.1 |

*sehingga September 2013

Di samping itu, terdapat juga Skim Amanah Saham yang dilaksanakan oleh Permodalan Nasional Berhad (PNB) yang telah berjaya meningkatkan pegangan ekuiti Bumiputera dalam pasaran modal. Sehingga 31 Disember 2012, pegangan pelaburan Bumiputera di bawah Skim Amanah Bumiputera bernilai RM110.3 bilion. PNB turut menawarkan unit pelaburan kepada rakyat Malaysia melalui beberapa skim seperti Amanah Saham Wawasan 2020 (ASW2020), Amanah Saham Malaysia (ASM) dan Iain-lain.

Read the rest of this entry »

Malaysia: High Income Nation, but Low Income Rakyat

Posted by Kit in Economics, Finance, Malaysian Dream, Najib Razak, NEP on Tuesday, 22 October 2013

By Anas Alam Faizli

Oct. 22, 2013

Malaysia’s current socio economic structure can be summed up in four words, “Rich Malaysia, Poor Malaysians.” Malaysia is blessed with abundant natural resources with petroleum being the most precious. Add the land, other commodity resources, large youthful population and the country has all the essential ingredients to flourish. How then did this small nation of 30 million manage to end up with the unsolicited title of among the region’s most unequal nation between the rich and poor. What happened? Read the rest of this entry »

Services not shortcut out of middle-income trap, ADB tells Malaysia

By Zurairi AR

The Malay Mail Online

August 27, 2013

KUALA LUMPUR, Aug 27 — Industrialisation remains a vital step countries like Malaysia can ill afford to skip if they hope to beat the middle-income trap, the Asian Development Bank (ADB) cautioned as more emerging nations gave in to the siren call of the services sector.

In its flagship annual statistical publication Key Indicators for Asia and the Pacific 2013, ADB noted that Malaysia was among nations whose economies were transforming more slowly compared to heavily industrialised economies such as Hong Kong, Japan, South Korea, Singapore, and Taipei.

This warning comes as Malaysia continues to move away from manufacturing towards knowledge-based economy and the services sector, having started down the route with the Third Outline Perspective Plan (OPP3) between 2001 and 2010.

“Our analysis indicates that manufacturing is a developmental stage that generally cannot be bypassed on the road to becoming a high-income economy,” said a special chapter in the report titled “Asia’s Economic Transformation: Where to, How, and How Fast?”

“Virtually all countries that are rich today industrialised in the past — for a sustained period, their shares of both manufacturing output and manufacturing employment reached at least 18 per cent in gross domestic product (GDP) and total employment.” Read the rest of this entry »

Malaysia next in crosshairs as Asian contagion risks grow

By Stuart Grudgings

Reuters | Wed Aug 21, 2013 3:08am IST

Aug 21 (Reuters) – Indebted, commodity-dependent Malaysia will be in investors’ crosshairs on Wednesday as heavy selling of Indonesia and India’s currencies threatens to spread to other Asian economies seen as most vulnerable to a withdrawal of U.S. monetary stimulus.

After Indonesia, where concerns over a gaping current account deficit sparked a stock market and currency rout this week, Malaysia and neighbouring Thailand are seen as the most vulnerable Southeast Asian markets to contagion effects.

“There is a lot of resemblance to prior crises like 1997-98. We have had two countries going down, India and Indonesia, and now you have got to start thinking about the third and fourth countries,” said Pradeep Mohinani, a Nomura credit analyst in Hong Kong.

“The likely candidates would be those with high fiscal deficits, slowing economies and high foreign ownership of government bonds. Thailand and Malaysia tick most of the boxes in that regard.”

Economists say that both those countries, as well as the fast-growing Philippines, are to some extent protected from major turmoil by their much stronger external balances compared with Indonesia and India.

Read the rest of this entry »

Fitch pushes Malaysia’s credit rating outlook to negative

The Malaysian Insider

July 31, 2013

Global ratings agency Fitch Ratings has revised Malaysia’s sovereign credit rating outlook from stable to negative as the possibility of addressing public finance weaknesses has deteriorated after Election 2013.

The news comes as the Malaysian ringgit slid to three-year lows against the US dollar and 15-year lows against the Singapore dollar, making imports more expensive while exports would be cheaper although exports have slipped.

But it affirmed the country’s long-term foreign and local currency issuer default ratings at A- and A, respectively.

“Malaysia’s public finances are its key rating weakness. Federal government debt rose to 53.3% of gross domestic product (GDP) at end-2012, up from 51.6 percent at end-2011 and 39.8 percent at end-2008.

“The general government budget deficit (Fitch basis) widened to 4.7 percent of GDP in 2012 from 3.8 percent in 2011, led by a 19 percent rise in spending on public wages in a pre-election year,” it said.

But Fitch believed that it would be difficult for Putrajaya to achieve its interim 3 percent federal government deficit target for 2015 without additional consolidation measures. Read the rest of this entry »

Fight the Smear Campaign against the Oil Palm Industry

Koon Yew Yin

A few weeks ago the sky was covered with smoke from the burning of forests in Sumatra to clear land for agriculture. Many in Malaysia and Singapore were affected by the haze. Some observers in the west used it as an occasion to bad-mouth the oil palm oil further. In this article, I will try to share some facts of life in the oil palm industry so that Malaysians will not join the western world in their smear campaign.

Firstly, we must remember that the west had cut down their forests and trees centuries ago to develop their countries. Malaysia and Indonesia are both new comers in the development scene and have been felling our forests for only a few decades now. Of our tropical agricultural crops, oil palm is the most recent cash crop commodity.

Although there has been a rapid rate of exploitation, it still occupies a small proportion of our total land area. The oil palm industry in Malaysia accounts for 15.5 per cent of total land area and only 4.5 per cent of total land area of Indonesia. A large proportion of the oil palm plantations are also not newly felled forest but are old rubber plantations that have been converted to this more lucrative crop.

Many in the public know of my views which are critical of many developments in the country. However, praise needs to be given when it is deserved; and our home grown oil palm industry is one which deserves all our support. This support is important in view of the sustained criticism made against the oil palm industry by lobby groups that have their origin in the west.

Read the rest of this entry »

Malaysian government-linked corporations crowd out private investment

by Jayant Menon, ADB and ANU, and Thiam Hee Ng, ADB

East Asia Forum

April 25th, 2013

Private investment in Malaysia never fully recovered from the impact of the Asian financial crisis.

Foreigners have continued to shun Malaysia, but it now seems that even domestic investors are fleeing, with Malaysia becoming a net exporter of capital since 2005. One explanation for the sluggish performance of domestic private investment relates to the crowding-out effect of the growing dominance of government-linked corporations (GLCs) in many sectors. The influence of GLCs, however measured, is both widespread and pervasive.

The GLC share of operating revenue is approximately one-third in the aggregate, and they control more than half the industry share in utilities, transportation, warehousing, agriculture, banking, information communications and retail trade. GLCs employ around 5 per cent of the national workforce and account for approximately 36 per cent and 54 per cent, respectively, of the market capitalisation of Bursa Malaysia and the benchmark Kuala Lumpur Composite Index. Read the rest of this entry »

On Malaysia’s debts and ‘growth at all cost’

by Pak Sako

Centre for Policy Initiatives

I refer to the article in The Malaysian Insider/New Mandala on reducing Malaysia’s debt burden by Nurhisham Hussein, an economist with Malaysian Rating Corporation Berhad and former employee of Permodalan Nasional Berhad.

It is encouraging to have him participate in this national conversation on Malaysian debt.

Close to 20 prominent Malaysian academics, comprising economists and political scientists, had earlier urged the Barisan Nasional and Pakatan Rakyat to state the steps for remedying the worrying situation of Malaysia’s finances (see ‘Academics call upon Barisan and Pakatan to declare policy positions on national finance and debt‘, Centre for Policy Initiatives, 8 April 2013). Read the rest of this entry »

The NEP and Corruption: Why Malaysia is Lagging Behind

Posted by Kit in Corruption, Economics, NEP on Saturday, 13 April 2013

By Koon Yew Yin | 13th April 2013

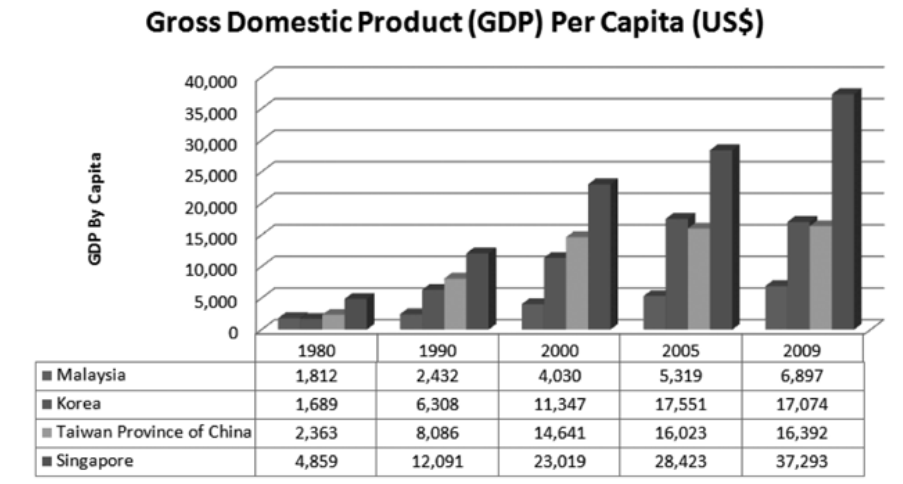

My object in writing this is to support Professor Dato Dr. Woo Wing Thye’s lecture on 12th April in Syuen Hotel, Ipoh. In his lecture he listed 5 root causes for our poor performance in comparison with South Korea and Taiwan.

Prof. Woo, possibly because of the election fever, tried to be politically correct and made little mention of the New Economic Policy role in our failure to keep up with our neighbours. In fact it is not only Prof. Woo who is silent on the NEP – most analysts appear to have sidelined this policy in the election debate to date.

This is a mistake as the real policy culprit explaining our failure to devlop as quickly as our neighbours (see table attached) is the New Economic Policy (NEP) and the abuse of power in the B.N. Government’s implimentation. As a result, our neighbours are doing much better than us in spite of the fact that they all did not have the natural resources such as oil and gas.

A rejoinder to Pemandu’s “We didn’t lower the GNI figure”

In an unsigned article entitled “Pemandu: We didn’t lower 2009 GNI figure”,(Malaysiakini Apr 8, 2013) Pemandu has made a feeble attempt to defend itself from the allegations that it had manipulated the GNI estimates contained in its Annual Report.

The article contains 11 points; the article is contentious and the claims and assertions being made are open to challenge.

This Rejoinder exposes the many fallacies and untenable statements offered by Pemandu in its own defense. The 11 points are taken up sequentially.

The article begins by a flat denial that the GNI per capita figure for 2009 was deliberately and that it had an intention to mislead the public. The primary attempt at defending the number is that the unrevised GNI figure for 2009 was used in the preparation of the Annual Report issued last month because that was the number used originally at the starting point of Pemandu’ s launch as a bench mark.

This is rather simplistic.

Pemandu appears to be in a state of denial and is offering a rather lame defense. It ignores the fact that professionally, all assessments are normally based on the latest available data.

What Pemandu did in its Report was either unprofessional or an act of incompetence or a deliberate attempt to hoodwink. The effect was to present “feel good” results.

Read the rest of this entry »