By R. Chander

BACKGROUND

This note, in three parts, focuses on the public sector debt in Malaysia. Part I presents a brief overview of the manner in which the Najib administration approached the issue of public sector debt. Part II presents a summary view of the assessment made by the International Monetary Fund (IMF) in the course of the annual Article IV Consultations completed earlier this year. The IMF Report was critical of the manner in which debt reporting was conducted by the previous administration. Part III looks to the future and makes a number of observations concerning the most appropriate manner in which the new Pakatan Harapan government could better manage Malaysia’s public sector debt.

PART I: THE NAJIB ADMINISTRATION AND PUBLIC SECTOR DEBT

Following the defeat of the BN led Federal Government and the take over of the reins by the Pakatan Harapan (PH)coalition, there has been intense and critical attention paid to fathoming the true nature and size of the Malaysian Government’s public debt obligations.

The BN administration, under Prime Minister Datuk Seri Najib Abdul Razak, had been less than transparent about the true size of the Government’s liabilities. The Najib administration chose an approach that was designed to obfuscate by being less than transparent.

The strategy that appears to have been put in place had a number of components. First, the annual Federal Government budgets (as presented to Parliament) recorded for most years a modest deficit; such deficits were financed by borrowings in Ringgit denominated loans. Direct borrowings from foreign sources were minimal. However, foreign hedge funds and other investors held sizable holdings of Malaysian ringgit denominated paper. These holders were attracted in part by the relatively higher returns from Malaysian government debt instruments at a time when interests rates were at record low levels.

Total Federal Government debt was kept to a level averaging just above 50 percent of GDP. Much of the financing of development projects was however from off budget loans raised by publicly owned/controlled corporations and entities. These loans appear, for the most part, to have been guaranteed by the Federal Government. These guarantees represented contingent liabilities of the Federal Government but were not fully reported. The net effects of these practices were several. These included: a) by-passing the obligation to obtain Parliamentary approval and accountability; b) off budget borrowing obscured the size of debt and permitted the ignoring of self-imposed and statutory limits on public sector indebtedness; c) the virtual out sourcing of development projects provided an opportunity to ignore procurement rules e.g. the need for competitive bidding.

Reporting of debt data was partial and lacked clarity or any semblance of full disclosure. The three main sources of data were Bank Negara Malaysia’s Quarterly Statistical Bulletin, the Bank Negara SDDS website containing economic and social data based on IMF mandated conventions and thirdly the Treasury’s annual Economic Report.

All three sources had limitations: a) The Bulletin provides no details about off budget borrowings or continent liabilities b) SDDS table (see Table 1 below) is also silent about off budget borrowings; it does however incorporate data on Federal Government guarantees without any acknowledgement that these guarantees are, in a strict sense, contingent liabilities. Furthermore, no details are provided as to the nature of these guarantees. c) Economic Report incorporates several tables; the focus of these tables was on Federal Government debt; a single table reported on the consolidated public sector debt made up of the i) Federal Government Budget based transactions ii) borrowings by Statutory bodies and iii) the debt of a group of 29 Non -Financial Public Corporations (NFPC)(see Tables below).

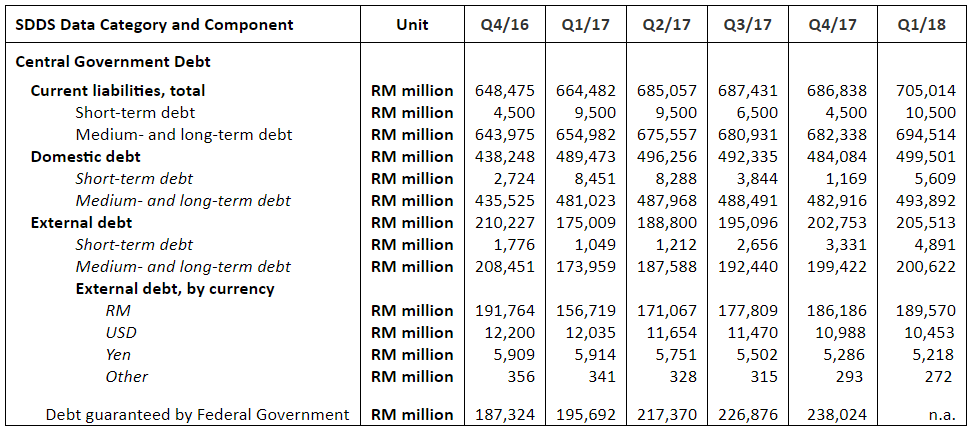

Table 1: FEDERAL GOVERNMENT DEBT

Source: Bank Negara Malaysia, SDDS website

This table shown here is truncated for reasons of space.

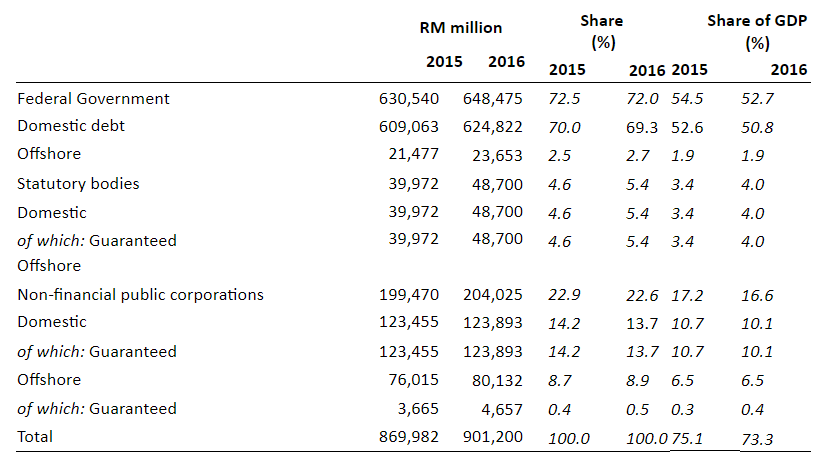

Table 2: CONSOLIDATED PUBLIC SECTOR DEBT

ECONOMIC REPORT 2017/18

Table 4.9. Public Sector Debt

2015 – 2016

Source: Ministry of Finance, Malaysia. Economie

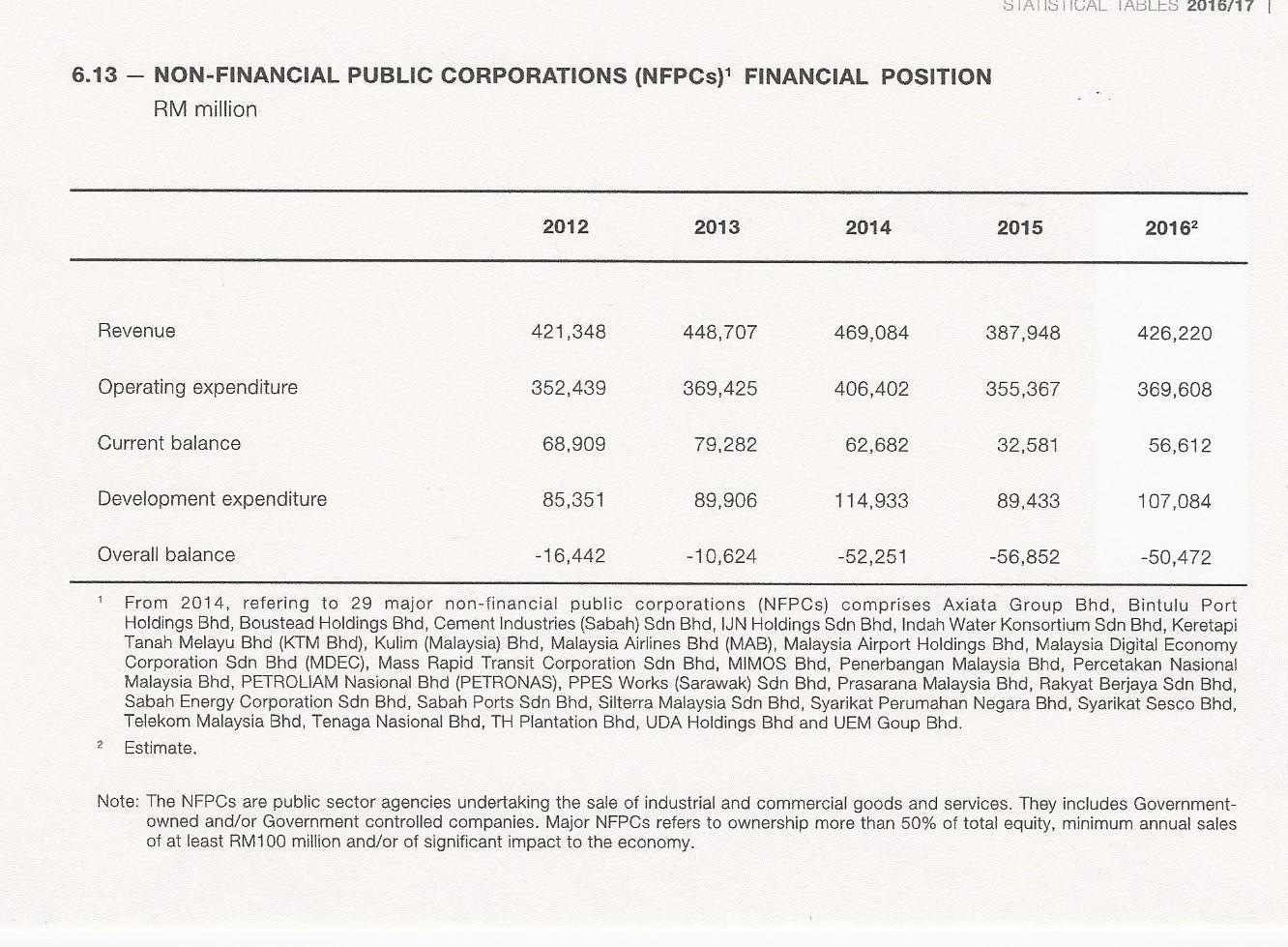

Table3: Non-Financial Public Corporations

Little information has been provided about the criteria used for selection of the 29 NFPCs. Footnote to Table 6.13 in the Economic Report is far from helpful. The criteria, if applied objectively, would preclude the exclusion of important entities such as 1MDB. Large loans linked with the High Speed Rail Link and the East Coast Railway Link Project were not highlighted in the Economic Report or the Budget presentation.

In brief, off-budget borrowing and the granting of guarantees to NFPCs and other favored entities coupled with less than full disclosure about the coverage of all NFPCs contributed to flawed reporting and less than transparent accounting.

It will be observed that the total reported in the Economic Report as the consolidated public sector debt at the end of 2016 amounted to RM 901 billion. This figure appears to be close to the amount of RM1.087 trillion reported by the new Finance Minister as the debt outstanding as of the end of 2017. This latter figure was however calculated using a somewhat unconventional approach; it was derived from an aggregation of Federal Government debt of RM686.8 billion, Government guarantees of RM199.1 billion, Lease payments for public-private projects of RM201.4 billion.

PART III: THE IMF ASSESSMENT

The report by the IMF following the 2017 Annual Article IV Consultations was laced with numerous observations concerning fiscal transparency, risk management, the high level of contingent liabilities and loan guarantees by the Federal government. Some of these critical observations were couched in terms that departed from the Fund’s usual nuanced language. While Government officials attempted to placate Fund staff by stating that actions were either being taken or under consideration, there is no evidence that this was indeed the case.

Although the IMF Report was publicly available and was referred to by main stream media, such reporting was selective and picked on growth prospects, upward revisions to GDP forecasts (largely linked to a recovery in international oil prices). None of the critical observations or those deemed to be negative were reported or commented upon.

The IMF Report: Selected Quotes

Fiscal transparency and fiscal risks management could be further enhanced. Following the formulation of key projections under the Medium-Term Fiscal Framework, started in 2015, the yearly communication of a more detailed set of accounts, underpinning the authorities’ medium- term objectives, and of annual fiscal risks statements, should be fully integrated in the budget preparation process. An explicit medium-term framework would help in identifying risks and developing risk mitigation strategies and would contribute to anchoring market expectations regarding the course of fiscal policy. A medium-term framework would also facilitate the work of the recently established Fiscal and Financial Committee on Risks and Liabilities, which aims at monitoring and mitigating fiscal risks. This is especially important given the high level of contingent liabilities. Loan guarantees by the federal government, which stand at 16 percent of GDP, are issued mostly to support infrastructure investment, frequently under public-private partnerships

*****************

Borrowing by state owned enterprises, which are in some cases under federal government guarantees, has increased in recent years and is projected to continue to increase in the medium term. 1 Gross debt of consolidated general government is not published by the authorities

*****************

Malaysia’s external debt remains manageable, although external financing vulnerabilities are higher than in the median peer country. Since end-2016, Malaysia’s external debt-to-GDP ratio has stabilized after rising by about 13½ percentage points in the previous seven years. About one-half of the increase in external debt was driven by a rise in nonresident investment in Malaysia’s local-currency debt market. External borrowing by nonfinancial corporations has also increased in recent years. Standard stress tests under the IMF’s External Debt Sustainability Analysis indicate that the external debt-to-GDP ratio would remain close to the baseline level under a variety of shocks over the medium term, except under an exchange rate depreciation shock (Appendix VI). However, about one-third of external debt is denominated in ringgit, which provides some cushion against exchange rate risks. Nonetheless, relative to the median peer country, Malaysia’s external financing vulnerabilities are higher, due to, for example, high amortization-to-GDP ratio, lower share of FDI liabilities in gross external liabilities, and slightly above-average potential claims on FX reserves from non-FDI liabilities.

*********************

A contingent liability shock, whereby the government would have to absorb all government guaranteed loans, totaling 15 percent of GDP, over two years, would increase risks significantly. This shock also includes a persistent shock to growth and interest rate increases. The debt-toGDP ratio would rise above 55 percent of GDP. Although this is a low probability scenario, the simulations underscore the growing vulnerability posed by contingent liabilities.

*****************

Despite the low share of foreign currency and short-term debt in public debt, Malaysia faces risks arising from its external financing requirement and relatively large share of public debt held by foreigners. At 39 percent, the external financing requirement is above the upper threshold of early warning benchmarks and the share of debt held by foreigners is relatively high at about 30 percent of total. As discussed earlier, the existence of large domestic institutional investors who tend to make opportunistic investments is a mitigating factor.

*************************

Malaysia’s high level of government debt and gross financing requirement calls for using the higher scrutiny framework. Government’s gross debt increased sharply in 2009, reflecting sizable discretionary fiscal stimulus, declining real and nominal growth and a large fall in oil prices. Although growth has recovered since then, the primary deficit has remained high, pushing the debt to GDP ratio to about the authorities’ debt ceiling of 55 percent. Gross financing needs (GFN) peaked at 10.2 percent of GDP in 2013 and are expected to fall and remain below 8 percent in the medium term

*************************

Government finance statistics: There is a need to improve the timeliness, detail, and availability of data on nonfinancial public enterprises (NFPEs) and the state and local governments. Dissemination of more detailed data on non-listed NFPEs’ assets and liabilities and domestic and foreign financing by type of debt instrument and holder would be desirable; efforts in this direction will require continued close collaboration among the Economic Planning Unit (EPU), the Treasury, and Bank Negara Malaysia (BNM). There is also a need to disseminate more information on public private partnerships.

The Report contained two Appendices – Appendix IV: Public Debt Sustainability Analysis and Appendix VI. External Debt Sustainability Analysis -that ran simulations under different scenarios and offered policy options for debt management. There is no evidence as of this date that the measures proposed by the Fund have been acted upon by the then BN Government. There is some uncertainty as to the extent to which the new Government as had an opportunity to fully review the Article IV Consultations Report.

PART III: DEBT MANAGEMENT

The speed with which the new Finance Minister of the PH Government acted by issuing a Press Statement together with the statement by the newly installed Prime Minister were commendable actions. They were indicative of the seriousness with which the new Government saw a need for openness and transparency in addressing the economic challenges it faced. These early actions were in part designed to reassure the markets that the new Government was committed to act in a manner to promote stability and to pursue responsible policies. These actions had the intended calming effect on the markets; the public at large welcomed the greater transparency and sharing of information. It led to a surge in the expression of patriotism through contributions to the Tabong Harapan Fund which has attracted over RM 100 million in public donations. These were commendable initiatives and represented positive developments.

That said, it is important to take note of the fact that there were a number of less then positive aspects. The Minister’s Press Statement has been criticized as alarmist by citing the estimated size of the “government’s debt” of RM 1 trillion. The calculations deviated from the standard statistical framework established by the IMF and other international agencies. In citing the RM 1 trillion figure, no attempt was made to distinguish between foreign and domestic debt.

The overall impression conveyed to the public at large was that Malaysia was on the verge of a serious debt crisis akin to what a number of Latin American countries such as Mexico, Argentina had faced in the past. Segments of the public concluded that Malaysia would join a number of European Union countries such as Portugal, Italy, Greece (PIGs) in seeking assistance. This was far from the truth as Malaysia’s debt is made up substantially of domestic debt whilst that of the other countries was mainly foreign debt. Malaysia’s circumstances were thus different. It would have been more appropriate to focus on the size of the external debt.

The disclosure of the size of public debt was accompanied by a series of statements concerning the adoption of austerity measures, cancellation or suspension of a number of mega projects, intent to renegotiate bilateral loans arranged by the previous government etc. However, these actions were not fashioned as part of a coherent and integrated plan to tackle the issue.

The overall impression that has been created is that the PH Government will pay off the debt even as it restores certain subsidies, eliminates the GST and embarks upon new programs. The reality is that repayment of debt is unlikely; at best some reduction in liabilities is likely. The inconsistencies inherent in this populist mix are likely to come back to haunt the coalition. It is thus imperative that steps are taken urgently to develop a coherent DEBT MANAGEMENT PROGRAM.

As a first step there is an urgent need to improve the scope of Government Finance Statistics. Greater transparency pertaining to the activities of all publicly owned corporations is essential. Meaningful consolidation of public finances is demanded as it will provide the basis for evidence based decisions.

It is not feasible to present a fully designed Debt Management Program. Some key considerations in the design of such a program should be:

- Separate total public debt into a) Foreign and b) Domestic debt to provide focus and targeted policies;

- Malaysia’s foreign debt is made up of two parts. In the first part foreigners hold a sizable part of Malaysian debt instruments. These need careful surveillance as volatile movements can impact on external stability and the exchange rate. A second part of the stock of foreign debt is made up of the significant loans associated with the mega projects contemplated by the previous Government. Two approaches are already being taken by the PH Government. Proposals are being developed to either cancel projects or renegotiate the terms of these loans. The renegotiations will demand actions embracing size, servicing terms, etc., and in certain instances debt-equity swaps should be an option for consideration. Prudent management of the external debt , by the Ministry of Finance, would be greatly aided by the use of tools outlined in the IMF’s External Debt Sustainability Analysis Report. While some reductions could be achieved, the more important element would be to restrain further large scale foreign borrowings.

- Management of domestic debt will require a host of actions. Briefly this would need to include:

- A combination of austerity measures, removal of overlapping functions and increase in efficiency could contribute towards easing pressures on the Federal Government’s budget;

- The Federal Government’s narrow revenue base will need to be broadened. While new taxes may ultimately be needed to service the Government and to enable it to deliver on its electoral promises, there would appear to be scope for reviewing the various “incentives” that the BN Government extended to its crony corporate supporters. These so-called incentives are no more than a form of “corporate welfare” and have grown in successive budgets over recent years. It is time that the Government ensure that corporate entities pay a fair share of taxation.

- Off-budget borrowing by the Government via GLCs and other entities, as observed earlier in this note, has been the largest contributor to the growth of public sector debt. To prevent a reoccurrence, as a measure under the proposed Debt Management Program, the accounting system of the Federal Government should move from a cash basis to an Accrual System. This will provide a more realistic portrait of the public sector’s financial circumstances.

- The key reform that will need early implementation concerns the GLCs. These are in reality State Owned Enterprises (SOEs). They dominate activities across the entire economic spectrum; they are monopolies that hinder the entry of competing firms; these parastatals are open to abuse as demonstrated by the 1MDB saga and other scandals. Their impact in so far as debt is concerned is clearly enormous: they are able to borrow on preferential terms with the aid of government guarantees; there is minimal accountability and ample opportunities for abuse. It should be recalled that the Najib Government had promised restructuring and selective privatization of these entities. These promises were not delivered upon. It is important now to push through the long promised reforms. In so far as the existing debt of these entities is concerned, some or all of it should be restructured through debt-equity swaps. Alternatively, these debts should be written down as part of a restructuring effort preceding privatization. It should be noted that reforms of these nature will contribute to enhancing Malaysia’s competitiveness and help country loosen one constraint that is contributing to its entrapment as a middle income country.

CONCLUDING REMARKS

The IMF in its report on the Malaysian economy, following the 2017 Article IV Consultations, observed that despite the low share of foreign currency and short-term debt in public debt, Malaysia faces risks arising from its external financing requirement and relatively large share of public debt held by foreigners. At 39 percent, the external financing requirement was considered above the upper threshold of early warning benchmarks and the share of debt held by foreigners was relatively high at about 30 percent of total. These conclusions cannot be ignored but must receive close attention by the newly installed PH administration. Malaysian officials have modest experience in handling the complex issues and may need advisory technical help to develop and implement a coherent Program.

The Public Debt Sustainability Analysis prepared by the IMF offers useful tools and guidance. The analysis should be up dated periodically.

Datuk R. Chander: The author was the first Malaysian to hold the office of Chief Statistician of Malaysia in the 1960s and 1970s. He then went on to serve as the Senior Adviser to the World Bank’s Chief Economist/Senior Vice President from 1977 to 1996. Upon retirement from the Bank he has functioned as an international advisor to multiple international agencies and governments.

Washington DC

July 1st, 2018