BY KHAIRIE HISYAM | Kinibiz

DECEMBER 20, 2015 10:30AM

On Nov 23, 2015, 1MDB announced that it has signed a deal with China General Nuclear to sell its power assets in return for RM9.83 billion in cash. This sale at a massive loss brings full circle its questionable purchases of the power assets while paying grossly inflated figures several years ago.

________________________________________________________________________

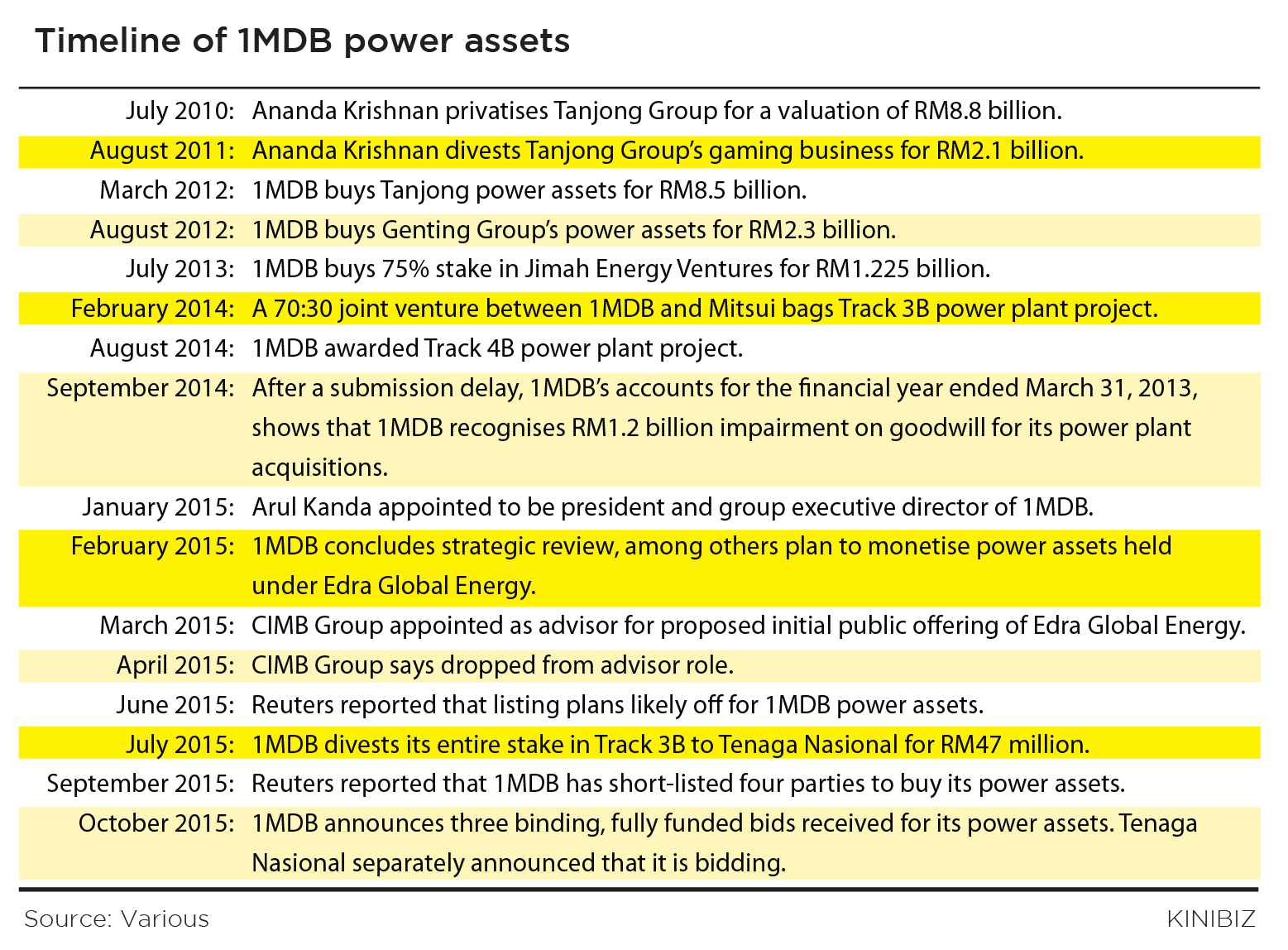

Most of 1MDB’s power assets were acquired within a 16-month time frame between March 2012 and July 2013. The spending spree raised many questions at the time, which remain unsatisfactorily unanswered as at writing time.

The underlying logic of buying over independent power producers (IPPs), as understood by market observers, would likely be the strong cash flow.

In simple terms, IPPs have a steady stream of cash flow by virtue of their power purchase agreements (PPAs), which are iron-clad agreements that guarantee a steady stream of money in exchange for a steady level of power generation as stipulated in the agreement.

This helps with 1MDB’s growing pile of debt at the time as strong cash flow would enable the company to service its obligations. Having issued a RM5 billion bond in 2009, 1MDB later issued more debt papers and by March 31, 2012, when its 2012 financial year ended, 1MDB’s total borrowings came to RM7.93 billion.

However, its trail of acquisitions raised eyebrows for the wrong reasons – the market at the time was abuzz with how the company strangely paid a generous premium for the power assets.

By conservative estimates, the company, forking out RM12 billion or so overall, overpaid by some RM3 billion.

First acquisition: Tanjong

The first acquisition was made in March 2012 when 1MDB paid RM8.5 billion to buy over tycoon Ananda Krishnan’s Tanjong Energy Holdings, which is now known as Powertek Energy Group.

The first acquisition was made in March 2012 when 1MDB paid RM8.5 billion to buy over tycoon Ananda Krishnan’s Tanjong Energy Holdings, which is now known as Powertek Energy Group.

However, this raised eyebrows at the time as just two years prior Ananda had taken the Tanjong Group private at a valuation of RM8.8 billion. While the valuation seems similar, an important point was the original Tanjong Group comprised not only power assets but also gaming and other businesses.

After the privatisation, Ananda then sold off the gaming components for RM2.1 billion to a consortium which, among others, comprised businesspeople William Cheng of Lion Group, Quek Leng Chan of Hong Leong Group and Lim Kok Thay of Genting Group.

Simple arithmetic meant the power assets under Tanjong must have been less than RM6.7 billion in value and closer to RM6 billion as Tanjong had other assets besides gaming and power, compared to what 1MDB paid.

In other words, for its first acquisition 1MDB would have overpaid by at least RM1.8 billion and by as much as RM2.5 billion.

Second acquisition: Genting’s assets

Five months after the deal to buy Ananda Krishnan’s Tanjong assets, 1MDB announced it was buying Genting Group’s power assets held under Mastika Lagenda Sdn Bhd for RM2.3 billion. However, at the time this also raised concerns as the power supply concession for the power assets was expiring by February 2016.

This sparked questions of whether this is another overpriced deal. In a separate announcement, Genting stated it expects to “record a one-off nett gain of approximately RM1.9 billion from the proposed disposals”.

While the power supply concession for the Genting power assets had since been extended by 10 years to 2026, it is unclear whether 1MDB had prior knowledge of this when undertaking the acquisition.

Industry sources say the terms for extension of the concession were made at a low purchase price for power which would have cut the Genting power assets valuation to about RM1 billion, implying an overvaluation of RM1.3 billion.

Third acquisition: Jimah

Nearly one year after buying over Genting’s power assets, in July 2013 1MDB announced its acquisition of a 75% stake in Jimah Energy Ventures Holdings for RM1.23 billion.

Most market observers agree, however, that this particular acquisition seem priced at fair market value.

In any case, the premium paid for the power assets showed in 1MDB’s annual reports. For the financial year ended March 31, 2013, during which it bought the Genting and Jimah power assets, 1MDB recorded some RM1.2 billion in impairment assessment for goodwill, though it did not specify to which acquisition in particular.

In any case, the premium paid for the power assets showed in 1MDB’s annual reports. For the financial year ended March 31, 2013, during which it bought the Genting and Jimah power assets, 1MDB recorded some RM1.2 billion in impairment assessment for goodwill, though it did not specify to which acquisition in particular.

Taken together, the emerging picture is 1MDB generously overpaid by RM3.1 billion to RM3.8 billion when it should have paid between RM 8.2 billion and RM8.9 billion for the three acquisitions collectively instead of RM12 billion.

This is particularly glaring after 1MDB announced on Nov 23, 2015 that it is selling the power assets to China General Nuclear for a total sum of RM9.83 billion in cash – the shortfall is roughly a little more than RM2 billion.

Valuing the power assets

To be fair, however, after the three acquisitions between 2012 and 2013, 1MDB subsequently built on its acquired track record to bid successfully for two new power plant concessions.

The first, won in February 2014, was codenamed Track 3B and entails two coal-fired power plants in Jimah, Negeri Sembilan with total generation capacity of 2,000MW.

However, liquidity issues, which cast doubt on its capability to undertake the project, forced 1MDB to sell its 70% stake in Track 3B to Tenaga Nasional for RM47 million, a transaction completed in July this year. Its partner Mitsui & Co, however, retains its 30% stake in the project.

The second is codenamed Track 4B, which was reportedly awarded in August 2014. To be located in Malacca, the facility would have a generation capacity of up to 2,400MW.

Therefore, in considering the power assets it bears mentioning that the RM9.83 billion that China General Nuclear is paying also includes ownership of Track 4B, which is yet to be built. In other words, since there would also be some value attached to this particular project, the shortfall from the disposal of the three power assets 1MDB originally bought would have been slightly bigger than stated above.

It is tricky to put a valuation on a power plant that has not yet been built – it would depend crucially on what the PPA will be. Sources say the power purchase price has not been determined yet but it could be based on the price for what Tenaga Nasional got for the Prai power plant.

If that is used as a benchmark, the value of the project may not be that high. Recall that Edra sold 70% of 3B to Tenaga Nasional for RM47 million.

If we were to be generous and put a value of RM1 billion on 4B, the range of value for 1MDB would rise to RM9.2 billion to RM9.9 billion. And it could come in lower if we were to take into account that most of the concession periods have been shortened by several years since 1MDB purchased them. The analysis, however, excludes debt of RM8 billion in Edra.

This, however, is a very simplistic analysis in the absence of further technical details which would only be available to parties privy to the PPAs, which fall under the Official Secrets Act. Depending on what is disclosed, these details may impact the true valuation of the assets.

What remains exceedingly clear, however, is that 1MDB grossly overpaid by several billion for its power assets between 2012 and 2013 – an uncharacteristic generosity – by undertaking debt to do so and is now selling them at a loss to repay those debts back.

Yesterday: The RM7 bil PetroSaudi caper

Tomorrow: 1MDB’s love affair with the Arab world