BY P. GUNASEGARAM | Kinibiz

DECEMBER 17, 2015 8:00AM

In just one year, 2013, 1MDB had a huge US$6.5 billion (some RM27 billion at current exchange rates) of borrowings from bonds arranged by Goldman Sachs, nearly 65% of total borrowings. The problem is that it is not possible to ascertain how the funds were used.

________________________________________________________________________

In 2013, 1Malaysia Development Bhd (1MDB) finalised US$3.5 billion through two bonds of US$1.75 billion each, both jointly guaranteed by 1MDB and International Petroleum Investment Co (IPIC). They carried effective interest rates of close to 6% (see Part 3 of this issue on the bond mispricing).

And then there was the US$3 billion bond, also priced at around 6% effectively, which had a letter of support from the Malaysian government.

Basically, the first tranche of US$1.75 billion worth of borrowings was to be used to fund the purchase of Tanjong Energy (US$810 million) and the rest for general corporate purposes. The second tranche of US$1.75 billion was to be used to fund Mastika Lagenda (Genting Sanyen) (about US$692 billion), with the balance for future acquisitions and general purposes.

Basically, the first tranche of US$1.75 billion worth of borrowings was to be used to fund the purchase of Tanjong Energy (US$810 million) and the rest for general corporate purposes. The second tranche of US$1.75 billion was to be used to fund Mastika Lagenda (Genting Sanyen) (about US$692 billion), with the balance for future acquisitions and general purposes.

But here’s the strange thing – despite the borrowings of US$3.5 billion (RM14.7 billion at an exchange rate of RM4.20 per US dollar or RM11.55 billion at RM3.30 per US dollar), there were substantial energy-related loans in the books of 1MDB as at March 31, 2014, the latest balance sheet date.

These include a RM6.17 billion syndicated loan, another one for RM452 million and a term loan of RM600 million, making in all a total of RM7.2 billion in energy loans, which were not repaid from the borrowings. Why is this so when the total borrowings at that time from these amounted to a massive RM11.55 billion at least?

Also, if 1MDB had not invested in the PetroSaudi caper or recovered the RM7 billion plus it had in the venture, it would have been enough to cover a substantial part of the cost of energy acquisitions.

Now that’s just the tip of the iceberg. In return for IPIC being joint guarantor of the loan, some US$1.4 billion or 40% of the US$3.5 billion bonds value had to be kept in deposits with IPIC subsidiary Aabar Investments PJS. In other words, 1MDB had use of only 60% of the nett proceeds of the US$3.5 billion.

Worse, The Wall Street Journal reported earlier this year that this US$1.4 billion (RM5.88 billion at current exchange rates) payment to Aabar is missing. The newspaper said that a further RM993 million that 1MDB paid to IPIC could also be missing.

Also as part of the deal to guarantee the US$3.5 billion bonds, Aabar had an option to purchase a 49% stake in the energy assets. To extinguish this option Aabar was paid a massive RM4 billion which is one-third of the original cost of the power assets and 40% of the recent sale price of RM9.83 billion for the power assets.

While the proceeds for the extinguishing of the assets came from redemption of the Cayman Island assets, according to one statement, another states that the proceeds from a US$975 million Deutsche Bank term loan was used to pay for the option. This leads to confusion about which money was used to extinguish the options.

Effectively then, 1MDB raised some RM11.55 billion through the US$3.5 billion bonds but 40% or RM4.6 billion (at exchange rates then) went as security deposit to Aabar, which received RM4 billion as payments for extinguishing options and other interest payments.

The US$3 billion (RM12.2 billion at current exchange rates) bond that was guaranteed by a letter of support from the Malaysian government is just as bad, or worse.

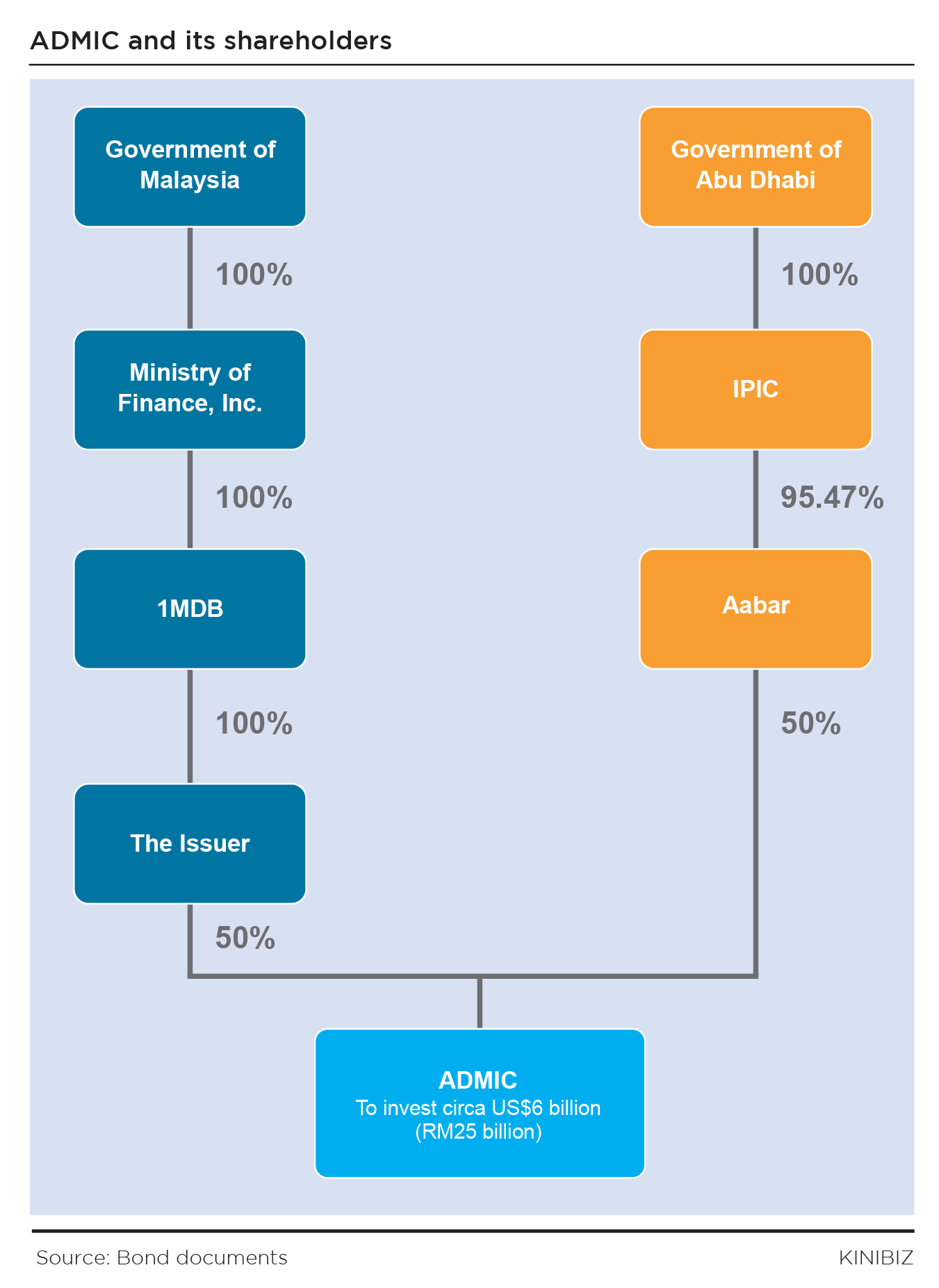

This was basically meant as a blank cheque investment into Abu Dhabi Malaysia Investment Co Ltd (ADMIC) which is a 50:50 joint-venture company between 1MDB and Aabar. The US$3 billion proceeds were to go directly into ADMIC and Aabar was to match this with its own funds of US$3 billion.

This was basically meant as a blank cheque investment into Abu Dhabi Malaysia Investment Co Ltd (ADMIC) which is a 50:50 joint-venture company between 1MDB and Aabar. The US$3 billion proceeds were to go directly into ADMIC and Aabar was to match this with its own funds of US$3 billion.

Until today, it is not clear if Aabar has paid up its share of the US$3 billion for the joint venture.

Goldman Sachs’ bond document has some shocking revelations and caveats. At the time of the offering, ADMIC had made no investments and “has no plans, arrangements or understandings with any prospective target businesses concerning an investment, acquisition or project.

“Consequently it is not expected that ADMIC will immediately have any revenues from its investments with which to pay dividends to the issuer in respect of the issuer’s 50% investment in ADMIC”. The issuer is 1MDB Global Investments Ltd, incorporated in the British Virgin Islands and wholly owned by 1MDB.

Thus, the entire bond issue is based on that letter of support from the Malaysian government which will have to bear the consequences of any non-repayment by 1MDB.

Further, the document, dated March 8, 2013, goes on to say that at the time of 1MDB’s investments of the nett proceeds in ADMIC, “it is anticipated that Aabar will NOT yet have contributed sufficient capital to meet its obligations under the joint-venture agreement.

“The issuer has no control over Aabar and there can be no assurance that Aabar will meet its funding obligations”.

It is shocking that 1MDB has undertaken to commit such funds to ADMIC without so much as getting a similar commitment from its joint-venture partner.

ADMIC did not have a formal investment plan then but planned to invest according to some criteria but “in certain cases, ADMIC may make investments which do not meet some (or all) of the factors” listed.

These factors include strategic value, strong value proposition, strong free cash flow, strong competitive industry position and experienced management team. However, even a cursory glance at its balance sheet indicates that it did not adhere to such criteria.

For sale investments, listed under current assets, amounted to RM12.9 billion and auditors cannot establish a proper value for them. Deposits and other cash equivalents amounted to RM9 billion, of which half could not be used because they are security deposits with Aabar.

Elsewhere 1MDB claimed that the US$3 billion is part of seed capital for the Tun Razak Exchange project but it seems to be far in excess of what is required especially considering that 1MDB is already making sales of land from this project and not developing it first and then selling.

Thus, despite RM42 billion of loans, or RM34 billion of loans if inherited loans from power assets of some RM8 billion are excluded, it has precious little to show in terms of assets other than the recently sold power assets valued at RM9.83 billion.

Yesterday: How 1MDB lost RM6 bil through bond mispricing

Tomorrow: How 1MDB overpaid Goldman Sachs