BY KINIBIZ

DECEMBER 16, 2015 8:00AM

1MDB has already lost some RM6 billion by mispricing its bonds. So was this deliberately done, and whose pockets ended up bursting at the seams?

________________________________________________________________________

A big chunk of 1Malaysia Development Bhd’s (1MDB) fundraising over the years had been through issuing bonds. However, the company had been massively underpricing its bonds, losing some RM6 billion according to KINIBIZ estimates – and this is not paper but real, cold, hard cash.

When a bond is issued, it has a coupon rate and a face value. The coupon rate typically remains constant over the life of the bond and is a promise by the issuer to pay a certain percentage of the face value of the bond each year.

Bonds are commonly priced to give roughly similar yields as other comparable bonds in the open market. Yields are the annual coupon payments for the year divided by the price of the bond. Yields are adjusted by raising or lowering the bond price – they move in opposite directions.

But bonds are fickle things where small changes make huge differences, especially if the maturity period of the bond is long.

For example, a RM5 billion bond priced to yield two percentage points more than market rates over 30 years can mean underpricing of at least RM1 billion. It’s like selling property below the market price only for the buyer to immediately flip it at market price, taking the difference as quick profit.

This was what 1MDB did with its bonds. Its various bonds over the years were priced to yield considerably more than going market rates at the time, which in turn heavily discounted the bonds’ prices compared to market levels.

The result was that the bonds were issued to unknown investors much cheaper than they should have been. These investors were then able to flip them into the open market at the higher prices 1MDB should have issued them at in the first place and pocket cold, hard cash in profits.

And the price difference was instant, clean profit for these unknown investors. No local institutions had access to these bonds, said traders, and the identities of those given this first bite have been kept secret.

Mispricing from the start

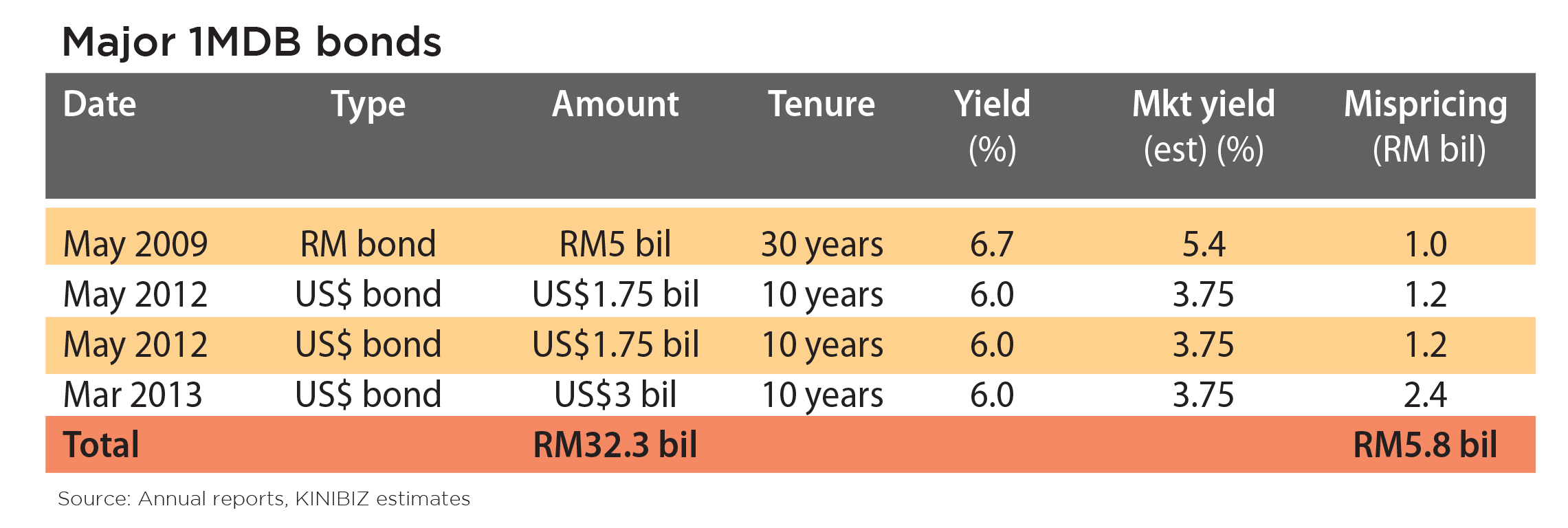

These mispricing shenanigans (see table) started from the very beginning, when 1MDB was still Terengganu Investment Authority (TIA), incorporated in February 2009 as a state sovereign wealth fund for Terengganu.

It started off by issuing a 30-year RM5 billion bond with 5.75% coupon rate, payable semi-annually and arranged by AmInvestment Bank Bhd. However, this bond was issued at a 12% discount or 88 sen for every RM1 par value. 1MDB’s annual report places this yield figure at 6.71%.

It started off by issuing a 30-year RM5 billion bond with 5.75% coupon rate, payable semi-annually and arranged by AmInvestment Bank Bhd. However, this bond was issued at a 12% discount or 88 sen for every RM1 par value. 1MDB’s annual report places this yield figure at 6.71%.

Before we attempt to find a more sensible yield figure for this bond, it is important to note that the 30-year tenure is unusually long compared to a maximum of 20 years for government securities.

When 1MDB (as TIA) issued this 30-year bond, Malaysian government securities were trading at a yield of roughly 4.8% while Cagamas bonds, which do not carry explicit government guarantee, traded at about 5.28% yield.

According to bond analysts, a 25-30 basis point (100 basis points = 1 percentage point) premium to government bonds is acceptable for a bond with explicit government guarantee such as TIA’s 30-year bond. If we add another 30 basis points for the extra 10-year tenure, the fair yield for this bond would come to about 5.4%.

However, the effective annual interest rate was at 6.71%, considerably more than this fair yield figure. This higher rate can only be achieved by lowering the issue price, meaning the bond was issued too cheaply considering the yield could have been lower around 5.4%.

Calculations using a bond calculator found the mispricing undervalued the RM5 billion bond by about 20%. In other words, whoever got that first bite would have pocketed RM1 billion by buying this bond at the undervalued price and subsequently selling it back to the market at more sensible prices.

Previous KINIBIZ checks found the bond was even traded at a premium of RM1.20 for a RM1 par value bond, a substantial 36% increase over the effective issue price of 88 sen per RM1 par value.

Such bond mispricing represents an upfront siphoning of money by undervaluing the bonds and selling them at market price, the penalty being paid by higher interest rates over the tenure of the bond.

Mispricing, again and again

In May 2012, 1MDB through its subsidiaries issued two more bonds at par value of US$1.75 billion apiece. These 10-year bonds were to finance its power assets shopping spree and were arranged by Goldman Sachs.

They were co-guaranteed by both 1MDB and Abu Dhabi’s International Petroleum Investment Co (IPIC), the latter being granted a 10-year option to acquire up to a 49% stake in 1MDB’s power assets come a future listing exercise in exchange for the co-guarantee.

They were co-guaranteed by both 1MDB and Abu Dhabi’s International Petroleum Investment Co (IPIC), the latter being granted a 10-year option to acquire up to a 49% stake in 1MDB’s power assets come a future listing exercise in exchange for the co-guarantee.

This option was later extinguished by paying US$1.23 billion or some RM5 billion to IPIC, the funds obtained from a term loan.

The coupon rates for these two bonds were between 5.46% and 5.8% for the first one, issued under 1MDB Energy Ltd, and between 5.60% and 5.7% for the second by 1MDB Energy (Langat) Ltd.

However, this indicates a mispricing as well, as yields for 10-year US Treasuries in May 2012 were in the 1.63%-1.98% range. In other words, the bonds, at roughly 6%, were priced about 425 basis points higher, if we assume the US Treasuries carried a rate of 1.75% then.

This is a strange difference. Around the same time Petronas’ bonds were trading at US Treasuries plus 185 basis points only. This means 1MDB bonds were priced some 240 basis points higher than its nearest comparable issuer in the Malaysian sector.

If we assume 1.75% as the rate for US Treasuries then, and a reasonable spread of 200 basis points, the issue should carry an interest rate of around 3.75%. Instead it was issued at 6%.

The implications are tremendous – the difference of 225 basis points would have undervalued each bond by about RM1.2 billion, or a total of RM2.4 billion for both, calculations show.

Letter of support

The two bonds of US$1.75 billion apiece were not the last that were arranged by Goldman Sachs for 1MDB. The investment banker also arranged another 10-year US dollar bond for 1MDB amounting to US$3 billion, backed by a letter of support from the government. This carried an effective interest rate (yield) of 6%, again implying similar mispricing.

The mispricing here could have amounted to as much as RM2.4 billion, assuming a similar mismatch in the rates as the earlier two US dollar bonds.

While the government has denied issuing an effective letter of guarantee for the bond issuance, the terms of the letter of support are unambiguous: should 1MDB fail to service its debt commitments vis-a-vis the US$3 billion bond issuance, the government would step in and provide financial support.

Deliberate intention?

The mispricing of 1MDB’s bonds happened multiple times. Once may be an error, twice may be a coincidence but thrice is a definite trend.

Like meat butchers who would know how to cut beef, bond professionals would have known what is involved in pricing bonds. Therefore it boggles the mind to imagine simple incompetence at work here.

And that leaves only one frightening, outrageous possibility: a deliberate intention to siphon off billions of ringgit.

Troubling questions arise. The most pressing are who the mysterious investors were and why they were effectively handed billions of ringgit in quick profit on a silver platter – all they needed to do for these handsome profits was to flip the bonds on the open market.

It does not end there. Who decided to give these mysterious investors the opportunity to make such windfall profits near-instantly and why? Did these mysterious investors give something to someone in return?

Into whose pockets did these lost billions really go into?

In light of these urgent questions, one report by Bloomberg in May 2013 stands out. The wire service had reported that Goldman Sachs made an eye-watering US$500 million from arranging three 1MDB bonds over the preceding year.

In light of these urgent questions, one report by Bloomberg in May 2013 stands out. The wire service had reported that Goldman Sachs made an eye-watering US$500 million from arranging three 1MDB bonds over the preceding year.

That was almost the same amount the federal government paid each month for its outstanding debt at the time. The firm’s revenue from the 1MDB bonds alone came at 7.7% of their collective face value, which is multiple times the normal commission rate.

Notably, Bloomberg reported that part of this US$500 million came from Goldman Sachs buying these bonds upfront at discounted rates and subsequently selling them at higher prices to investors.

The available clues on how 1MDB mispriced its bonds fit perfectly here. Was Goldman Sachs given the exclusive first bite at the massively underpriced cherries that were 1MDB’s bonds?

If yes, the pressing question is why 1MDB stood by and allowed Goldman Sachs to pocket such huge windfall profits upfront. Had this been a conscious decision, it may even amount to breach of fiduciary duty considering these lost billions rightfully belonged in 1MDB’s own coffers had the bonds been more sensibly priced.

In other words, these bond mispricing shenanigans border on the criminal. Yet sadly none of these losses would ever show up in 1MDB’s books. As a company wholly owned by the Minister of Finance Inc, the federal government’s arm, it is simply billions lost for Malaysia as a whole.

Yesterday: The colourful family and friends of 1MDB

Tomorrow: Other questionable use of loans – the Goldman bonds

#1 by donplaypuks on Saturday, 26 December 2015 - 12:04 pm

There’s an obvious link between the deliberately mispriced bonds and yields, and the $2.6 billion that’s floating around as though money grows on trees.

Grossmajib knows, as does Jho Paris Hilton, the truth about the heist of the century and who the mysterious bond-robbers were!

#2 by Bigjoe on Saturday, 26 December 2015 - 7:33 pm

The opposition has to explain how they let Najib keep telling the lie that 1MDB is “just a business issue that become political” and how they let Arul Kandasamy call his plan “rationalisation” plan in the first place.

The idiotic idea lost TENS of billions. It got bailed out with prime real estate that rival GST revenue. It’s very much ENTIRELY about people’s welfare.

The plan is no ” rationalisation”. It’s to prevent EVEN WORST loses – potentially disastrous. It’s a rescue, bringing sanity to idiocy.

How did the opposition let Najib and Arul get away with the nonsensical description?

#3 by cemerlang on Monday, 28 December 2015 - 9:08 am

Power to manage and administer the money because everyone knows what money can do. Scan all the financial accounts and go to the grounds to see if whatever it is worth your money. Scan to make sure all is okay. The pix says it all. A big heavy burden to everyone.

#4 by bumi-non-malay on Sunday, 27 December 2015 - 2:13 pm

ITS MIS-PRICED ON PURPOSE….PURPOSELY OVER PAY….. PURPOSELY Doomed For FAILURE PROJECT So as TO INCREASE the BURDEN on Rakyat Malaysia…Just Like Law and Order that are PURPOSELY Pust aside with No Further Action!!…Wake up Malaysian!!