Archive for category Financial Scandals

Fed Warned Goldman on Malaysia Bond Deals

Posted by Kit in Corruption, Financial Scandals, Najib Razak on Thursday, 7 April 2016

by Justin Baer and Bradley Hope

Wall Street Journal

April 6, 2016

Regulator raised concerns about risk to firm’s reputation from work on 1MDB transactions

Regulators at the Federal Reserve have raised concerns with Goldman Sachs Group Inc. that deals it helped put together for a controversial Malaysian government investment fund could have put the firm’s reputation at risk, according to people familiar with the matter.

Those deals are increasingly under a brighter spotlight, as additional details emerge about the alleged actions of the firm’s former Southeast Asia head who handled transactions for the fund, 1Malaysia Development Bhd. or 1MDB.

People familiar with the matter said the partner, Tim Leissner, was suspended from the firm for writing a letter vouching for a financier with ties to that fund. Mr. Leissner was suspended and later quit early this year after a review of his email found he had allegedly written an unauthorized reference letter on behalf of Jho Low, a Malaysian investor who helped found 1MDB and was involved in some transactions done by the fund, people familiar with the matter said.

When it disclosed Mr. Leissner’s suspension, Goldman didn’t name Mr. Low. The fact that Mr. Leissner wrote a letter of reference to another financial institution for someone involved in 1MDB puts the firm deeper into the controversy surrounding the fund, lawyers say.

People familiar with the matter said Mr. Leissner’s letter had included details on Mr. Low’s finances, while overstating the extent to which Goldman had done due diligence on him. Read the rest of this entry »

A sad and tragic contrast!

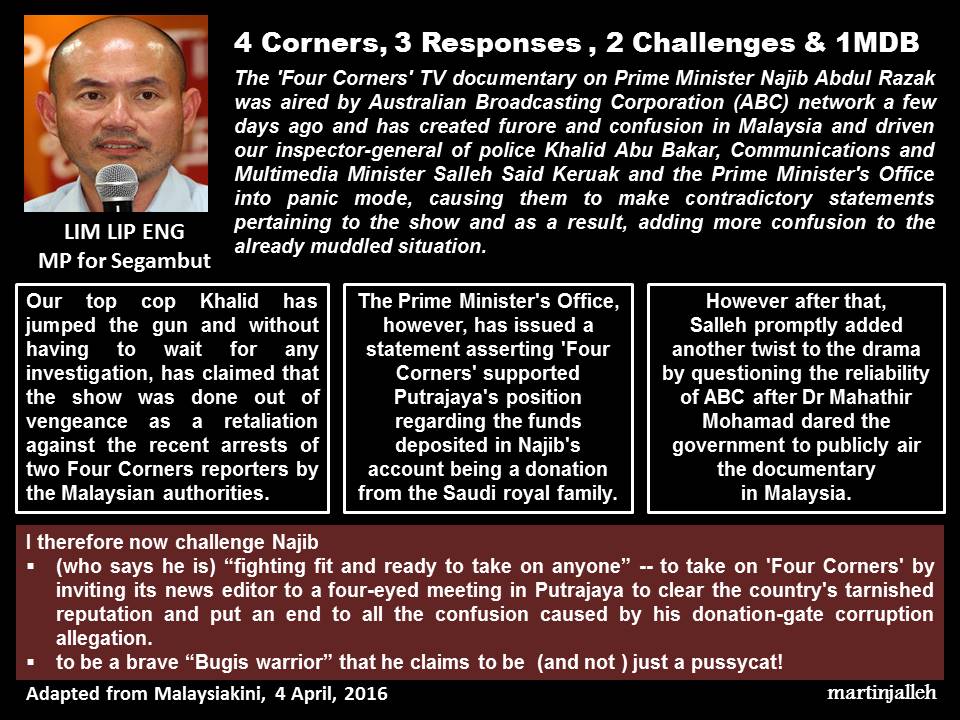

Posted by Kit in Financial Scandals, Martin Jalleh on Wednesday, 6 April 2016

By Martin Jalleh

The Tragic-Comedy Continues…

Posted by Kit in Financial Scandals, Martin Jalleh, Najib Razak on Tuesday, 5 April 2016

By Martin Jalleh

ANZ quizzed over AmBank link to Malaysia’s 1MDB corruption scandal

Posted by Kit in Corruption, Financial Scandals, Najib Razak on Tuesday, 5 April 2016

Leo Shanahan

THE AUSTRALIAN

APRIL 4, 2016

ANZ’s deputy chief executive and acting chief financial officer has been quizzed over the bank’s holdings in Malaysia’s AmBank amid the multi-billion dollar 1MDB corruption scandal engulfing that country’s government.

Appearing at a Senate committee looking into constructive default loans, Graham Hodges defended the role of ANZ in sitting on the board of Malaysian bank AmBank which held billions in the 1MDB funds at the centre of a global financial scandal.

With ANZ holding almost a 25 per cent shareholding in the Malaysian bank, ANZ has three permanent positions on AmBank’s board, which will soon include Mr Hodges himself and, formally, ANZ’s chief executive Shayne Elliott.

Under questioning from senators Mr Hodges described as “simplistic” allegations ANZ had governance questions to answer over AmBank and the scandal involving state investment fund 1MDB.

“Clearly the directors on that board are not at liberty to talk about what goes on … we do not control that bank. We are directors on that bank, it is a separately listed public company,” Mr Hodges told the committee in Sydney.

“As an ANZ executive and one which is a shareholder in that are we happy with that? Certainly not. But that’s different to implying that the culture or the integrity of one of the people who sat on the board is less than it should be because they’ve sat on the board.” Read the rest of this entry »

Malaysia’s government silencing dissent

Posted by Kit in Financial Scandals, Media, Najib Razak on Monday, 4 April 2016

Ross Tapsell, ANU

East Asia Forum

30 March 2016

The current scandal embroiling Prime Minister Najib Razak has led the Malaysian government to crack down on press freedoms. But a restricted mainstream Malaysian media has not stopped the publishing online of information on the ongoing corruption scandal surrounding the Prime Minister and 1Malaysia Development Berhad (1MDB). It remains to be seen whether Najib’s crackdown will secure his position or whether the media will help unseat him.

Earlier this year, Thomas Carothers from the Carnegie Endowment of International Peace described our current times as a ‘paradox’. Despite rapid and transformative advances in communications and information technology allowing for greater freedom of expression, the number of democracies today is basically no greater than it was at the start of the century. How has the ‘paradox’ unfolded in Malaysia?

Malaysia’s online media is not exempt from legal and state pressures, but former prime minister Mahathir Mohamad’s decision in 1996 not to regulate or censor the internet has allowed Malaysia’s online media to become a relatively more open and vibrant space.

Malaysia’s internet penetration rate is now at 68 per cent of the population and well over 80 per cent in urban areas. At the same time, newspaper circulation has decreased in government-owned newspapers such as Utusan Malaysia, The Star, The New Straits Times and Berita Harian. Print media circulation is dropping in most countries worldwide where internet penetration is rising. In Malaysia this has been fuelled by the reality that many Malaysians are tired of government-sponsored messages and are reaching for alternatives. Read the rest of this entry »

Malaysia’s big central bank challenge

Posted by Kit in Corruption, Financial Scandals, Najib Razak on Sunday, 3 April 2016

Nicholas Spiro

Nikkei Asian Review

March 29, 2016

Commentary

Emerging Asia’s central banks are sitting pretty, especially when compared with their Latin American counterparts.

Many of South America’s monetary guardians have been forced to raise interest rates aggressively over the past several months to combat a sharp rise in inflation, but emerging Asia’s central banks have been able to loosen monetary policy, with rate cuts in India, Indonesia, Taiwan and, most conspicuously, China.

Yet for Bank Negara Malaysia, the country’s central bank, these are challenging times. Read the rest of this entry »

World’s top banks in US government cross-hairs over dealings with Malaysia’s 1MDB

Posted by Kit in Corruption, Financial Scandals, Najib Razak on Sunday, 3 April 2016

by Praveen Menon and Saeed Azhar

Australian Financial Review Weekend

Apr 3 2016

US Department of Justice officials have asked Deutsche Bank and JPMorgan Chase & Co to provide details on their dealings with 1MDB, as global investigations into the troubled Malaysian state fund widen.

US Department of Justice officials also travelled to Kuala Lumpur to speak to senior bankers and other people with close links to the state fund, three people with direct knowledge of the matter told Reuters. They said JPMorgan and Deutsche were not the target of investigations at this stage, but had only been asked to provide details.

Deutsche Bank and JPMorgan declined to comment. The Department of Justice also declined to comment. Read the rest of this entry »

After Teoh Beng Hock outrage and tragedy, is MACC determined it will never again become a political pawn to persecute the Opposition?

Posted by Kit in Corruption, Financial Scandals, Lim Guan Eng, Najib Razak on Sunday, 3 April 2016

The Malaysian Anti-Corruption Commission (MACC) must convince Malaysians that after the Teoh Beng Hock outrage and tragedy, for which there is still no closure for the Teoh Beng Hock family and justice-loving Malaysians for Beng Hock’s death at MACC premises, it is determined never again to become a political pawn to persecute the Opposition.

UMNO/BN leaders have accused the DAP Secretary-General and Penang Chief Minister, Lim Guan Eng, of corruption in the RM2.8 million purchase of his bungalow resulting from the sale of Taman Manggis land to KLDIC.

Two wrongs do not make a right, and if Guan Eng is guilty of corruption in his RM2.8 million bungalow purchase, the full rigours of the law should be applied. However, the maxim that a person is innocent until proven guilty must be scrupulously observed.

In this case, the allegation of Guan Eng’s corruption over the sale of Taman Manggis land to KLDIC has proved to be baseless, as the Taman Manggis land had been sold by the Penang State Government via open tender to the highest bidder.

Even the allegation that the DAP-led Penang State Government had “robbed” the people of low-cost housing in Taman Manggis had easily been debunked with the declassification of the State Exco minutes of the Gerakan State Government in 2005 and 2007 which showed that the government back then had no plans whatsoever to build homes for the poor. In contrast, the DAP-led Penang State Government had commenced a separate low, low-medium cost and affordable housing less than two kilometres away in Jalan S.P. Chelliah which is nearly 10 times the size of the land in Taman Manggis.

While two wrongs do not make a right, this cannot be an argument to justify MACC abuses of power. Read the rest of this entry »

Murky Malaysian money trail that funded The Wolf of Wall Street – report

Posted by Kit in Corruption, Financial Scandals, Najib Razak on Sunday, 3 April 2016

Edward Helmore

Guardian

2 April 2016

The FBI reportedly believes that $100m of the Leonardo DiCaprio-starring film’s budget came from a Malaysian state fund for local economic development

Sources within the FBI have confirmed to the Wall Street Journal that more than $100m of the production budget for Martin Scorsese’s The Wolf of Wall Street came from a Malaysian state fund connected to a scandal that has damaged a senior Goldman Sachs banker and led investigators to examine the lifestyle of a notorious New York playboy.

According to the Journal, FBI investigators believe much of the cash used to make the Leonardo DiCaprio-starring film was never intended for the movie business. Instead, it originated with 1MDB, a Malaysian state fund meant to boost local economic development.

1MDB, the Journal reported, passed the money to Red Granite Pictures, a Hollywood production company controlled by Riza Aziz, stepson of the prime minister of Malaysia, Najib Razak, who set up 1MDB seven years ago.

1MDB also appears to be behind the lavish lifestyle of Low Taek Jho, known as Jho Low, a notorious New York party boy and friend of Aziz. Read the rest of this entry »

The Secret Money Behind ‘The Wolf of Wall Street’

Posted by Kit in Corruption, Financial Scandals, Najib Razak on Sunday, 3 April 2016

By Bradley Hope, John R. Emshwiller And Ben Fritz

Wall Street Journal

April 1, 2016

Investigators believe much of the cash used to make the Leonardo DiCaprio film about a stock swindler originated with embattled Malaysian state development fund 1MDB

LOS ANGELES—Despite the star power of Leonardo DiCaprio and director Martin Scorsese, the 2013 hit movie “The Wolf of Wall Street” took more than six years to get made because studios weren’t willing to invest in a risky R-rated project.

Help arrived from a virtually unknown production company called Red Granite Pictures. Though it had made just one movie, Red Granite came up with the more than $100 million needed to film the sex- and drug-fueled story of a penny-stock swindler.

Global investigators now believe much of the money to make the movie about a stock scam was diverted from a state fund 9,000 miles away in Malaysia, a fund that had been established to spur local economic development.

The investigators, said people familiar with their work, believe this financing was part of a wider scandal at the Malaysian fund, which has been detailed in Wall Street Journal articles over the past year.

The fund, 1Malaysia Development Bhd., or 1MDB, was set up seven years ago by the prime minister of Malaysia, Najib Razak. His stepson, Riza Aziz, is the chairman of Red Granite Pictures.

The 1MDB fund is now the focus of numerous investigations at home and abroad, which grew out of $11 billion of debt it ran up and questions raised in Malaysia about how some of its money was used. Read the rest of this entry »

The Wolf of Wall Street dragged into Malaysia corruption scandal

Posted by Kit in Corruption, Financial Scandals, Najib Razak on Sunday, 3 April 2016

Rob Crilly, New York

The Telegraph

2 APRIL 2016

Even with Leonardo DiCaprio on board, The Wolf of Wall Street – an 18-rated film about financial corruption – struggled to find the backing it needed.

It took a little known production company, Red Granite, to take the gamble on such explicit material and come up with the $100m or so needed to bring the film to cinema screens.

Now that company has been swept up in a corruption investigation amid allegations that some of the money used to make the film was laundered from a scandal-hit Malaysian firm founded by the country’s prime minister. Read the rest of this entry »

Donation or 1MDB funds? Luxembourg probe may uncover missing link

Posted by Kit in Corruption, Financial Scandals, Najib Razak on Sunday, 3 April 2016

Nigel Aw

Malaysiakini

2 Apr 2016

Malaysians may be wondering why a tiny European country is joining the growing global investigation into 1MDB, but the outcome of the Luxembourg probe could have great bearing on Prime Minister Najib Abdul Razak.

To begin with, the Luxembourg investigation does not indicate that it has anything to do with Najib.

But the Luxembourg probe is significant as it may solve an important missing link – the connection between 1MDB and a number of entities which have generously pumped billions of ringgit, claimed to be donations, into Najib’s personal bank accounts. Read the rest of this entry »

Dust over corruption allegations against Guan Eng’s RM2.8 million bungalow clearing up while monstrous sandstorm over Najib’s RM55 billion 1MDB and RM4.2 billion “donation” twin mega scandals building up to explosion point

Posted by Kit in Corruption, Financial Scandals, Lim Guan Eng, Najib Razak on Saturday, 2 April 2016

After a two-week relentless barrage by UMNO/BN strategists and cybertroopers, fully supported by the Malaysian Anti-Corruption Commission and the police, the dust over the corruption allegations against DAP Secretary-General and Penang Chief Minister Lim Guan Eng based on half-truths, lies and downright falsehoods, are clearing up while on the other hand, a monstrous sandstorm over Prime Minister Datuk Seri Najib Razak’s RM55 billion 1MDB and RM4.2 billion “donation” twin mega scandals is building up to explosion point.

UMNO/BN allegations that Guan Eng had purchased the bungalow as a result of corruption arising from the sale of Taman Manggis land to KLDIC has been proved to be baseless, as the Taman Manggis land had been sold by the Penang State Government via open tender to the highest bigger.

The other UMNO/BN allegation that the Penang State Government had “robbed” the people of low-cost housing has also been proved to be baseless, with the declassification of the State Exco minutes of the Gerakan State Government in 2005 and 2007 which showed that the Gerakan State Government at the time had rejected the use of the Taman Manggis land for People’s Housing Project (PPR) and proposed instead a mixed project of shophouses and government quarters. In 2012, the DAP-led Penang government had commenced a separate low, low-medium cost and affordable housing less than 2 kilometers away in Jalan S P Chelliah which is nearly 10 times the size of the land in Taman Manggis.

The MACC and Police have swung into immediate action, with some 15 MACC officers descending on the Penang Chief Minister’s office in Komtar, conducting a search for some four hours and carting away boxes of documents.

If the MACC had shown similar alacrity in investigating Najib’s twin mega scandals, MACC should be sending hundreds of officers to swarm and besiege the Prime Minister’s Offices in Putrajaya, and subject individuals involved in the twin mega scandals to intensive interrogation sessions, at least round-the-clock 12-hour interrogation sessions.

Would MACC dare to interrogate the Prime Minister, Datuk Seri Najib Razak, on a round-the-clock 12-hour sessions? Read the rest of this entry »

Authorities Investigating Malaysia’s 1MDB Fund Focusing on Bond Proceeds

Posted by Kit in Corruption, Financial Scandals, Najib Razak on Saturday, 2 April 2016

BRADLEY HOPE in New York, SIMON CLARK in London and YANTOULTRA NGUI in Kuala Lumpur

Wall Street Journal

April 1, 2016

Investigators in three countries studying trail of cash from Malaysia to Abu Dhabi, offshore bank accounts

Authorities in three countries investigating a Malaysian government investment fund appear to be focusing on what happened to the proceeds of $3.5 billion in bonds sold by the fund in 2012, according to people familiar with the matter.

Investigators in the United Arab Emirates, Luxembourg and Switzerland are looking at the trail of cash from Malaysia to Abu Dhabi and to offshore bank accounts for a portion of the bond proceeds that appears to have gone missing, the people said.

Authorities in the U.A.E. have frozen the personal assets of and issued travel bans to two former executives of an Abu Dhabi sovereign-wealth fund that had extensive dealings with the Malaysian fund, 1Malaysia Development Bhd., known as 1MDB, the people said.

The UAE’s actions indicate authorities have moved ahead in their probe into the dealings of Khadem Al Qubaisi and Mohammed Badawy Al Husseiny, both of whom had close connections to 1MDB, the people said. Mr. Al Qubaisi is an Emirati who was the managing director of an $80 billion Abu Dhabi investment fund, International Petroleum Investment Company. Mr. Al Husseiny, an American, was chief executive of another government investment company, Aabar Investments PJS, which is owned by IPIC.

The U.A.E.’s central bank issued the asset freezes, the people said, though it isn’t clear which U.A.E. government agency is running the investigation. Read the rest of this entry »

Luxembourg launches probe in Malaysia PM fund scandal

Posted by Kit in Corruption, Financial Scandals, Najib Razak on Saturday, 2 April 2016

Luxemburger Wort – English Edition

1 April, 2016

Money laundering probe

(AFP) Luxembourg on Thursday launched a money laundering probe linked to a corruption scandal embroiling Malaysian Premier Najib Razak who is accused of using money in a state-run fund for his own purposes.

Najib, 62, has been under fire over allegations that billions of dollars were stolen from 1MDB, the now struggling state firm he founded, and his acceptance of a $681 million overseas payment.

Reports have also emerged of the luxurious lifestyles, lavish spending and jet-set travel arrangements of his family, stoking calls for his resignation.

The Luxembourg prosecutor’s office said in a statement that it had launched the probe “following revelations about the alleged diversion of funds from 1MDB”. Read the rest of this entry »

1MDB Probe Shows Malaysian Leader Najib Spent Millions on Luxury Goods

Posted by Kit in Corruption, Financial Scandals, Najib Razak on Saturday, 2 April 2016

By TOM WRIGHT and BRADLEY HOPE

Wall Street Journal

March 30, 2016

Accounts of prime minister paid out $15 million for clothes, jewelry and a car

HONOLULU, Hawaii—On Christmas Eve 2014, Malaysian Prime Minister Najib Razak stepped onto Hawaii’s 18-hole Kaneohe Klipper course for a round of golf diplomacy with U.S. President Barack Obama.

Off the fairways, another side of Mr. Najib’s time in office was on display. Two days earlier, the prime minister’s credit card was charged $130,625 to Chanel in Honolulu, according to Malaysian investigation documents. A person who works at a Chanel store in the upscale Ala Moana Center recalls Mr. Najib’s wife shopping there just before Christmas.

The credit card was paid from one of several private bank accounts owned by Mr. Najib that global investigators believe received hundreds of millions of dollars diverted from a government investment fund set up by the prime minister in 2009. The fund, 1Malaysia Development Bhd., or 1MDB, today is at the center of corruption probes by authorities in Malaysia and at least five other nations.

The Malaysian investigation documents, viewed by The Wall Street Journal, contain bank-transfer information that provides the most complete picture to date of the money that flowed through the prime minister’s accounts over a five-year period, the majority of it, investigators say, originating from 1MDB.

They show for the first time how some of the money in Mr. Najib’s accounts allegedly was used for personal expenses. That included $15 million in spending on clothes, jewelry and a car, according to the bank-transfer information, involving stores in the U.S., Malaysia, Italy and elsewhere. Read the rest of this entry »

Deadly Najib Razak ‘gift’ scandal rocks Malaysia

Posted by Kit in Corruption, Financial Scandals, Najib Razak on Saturday, 2 April 2016

Amanda Hodge

South East Asia correspondent

The Australian

APRIL 2, 2016

On November 1, 2011 Malaysian Prime Minister Najib Razak received a personal windfall pledge so astonishing in size and nature that even close political allies have described it as “too good to be true”.

In language akin to that of a classic Nigerian email scam, Saudi Prince Saud Abdul Aziz Majid Al Saud praised Najib for his work in “governing Malaysia using Islamic principles”.

“In view of the friendship we have developed over the years and your new ideas as a modern Islamic leader, in addition to my earlier commitment, I hereby grant you an additional sum of up to $US375 million only (‘Gift’) which shall be remitted to you at such times and in such manner as I deem fit, either directly through my personal bank or through my instructed company bank accounts (such as Blackstone Asia Real Estate Partners limited),” the mystery prince wrote on private office letterhead.

“You shall have absolute discretion to determine how the Gift shall be utilised …. This is merely a token gesture on my part but it is my way of contributing to the development of Islam to the world.”

“For clarification, I do not expect to receive any personal benefit whether directly or indirectly as a result of the Gift,” he added.

In an act of extraordinary foresight — that someone might eventually question the hundreds of millions flowing into the Malaysian Prime Minister’s personal bank account — the letter goes on to indemnify him from suggestion of wrongdoing.

“The Gift should not in any way be construed as an act of corruption since this is against the practice of Islam and I personally do not encourage such practices in any manner whatsoever.”

The letter, obtained by Four Corners and published for the first time this week, is signed HRH Prince Saudi Abdulaziz Al Saud, but there is no further clarification of who he might be in the sprawling pantheon of Saudi family dynasties. No address, no email, no telephone number. Read the rest of this entry »

Guan Eng is an open book prepared to answer all questions about his RM2.8 million bungalow purchase while Najib is a closed book running way from questions about his twin mega scandals!

Posted by Kit in Anwar Ibrahim, Corruption, DAP, Financial Scandals, Lim Guan Eng, Najib Razak on Saturday, 2 April 2016

There are many reasons why Datuk Seri Najib Razak should step down as Prime Minister.

The first is of course the imposition of Goods and Services Tax (GST) which has caused great hardships to low-income Malaysians sandwiched between falling incomes and rising cost of living.

There are many other reasons why Najib should step down as Prime Minister, including:

• Catapulting Malaysia to the stratosphere and internationally regarded as among the top ten nations in the world infamous for global corruption because of the RM55 billion 1MDB and RM4.2 billion “donation” twin mega scandals.

• Refusal to come full and clean in accordance with the principles of accountability, transparency, democracy and good governance about the twin mega scandals, and even Parliament cannot be a venue to ask questions about Najib’s RM4.2 billion “donation” scandal. After a year of adverse international publicity, Malaysians and the world still do not have answers to basic questions like: Where the RM4.2 billion “donation” in Najib’s personal bank accounts from 2011 to 2014 came from and where the monies have gone to.

• Failure to sue international publications, especially Wall Street Journal and Australian Broadcasting Corporation, the former for the revelation of RM2.6 billion donations in Najib’s personal banking accounts and the latter for the latest revelation that donations deposited into Najib’s personal accounts were not just RM2.6 billion but exceeded RM4.2 billion from 2011 to 2014. Read the rest of this entry »

Luxembourg Prosecutors Look for Embezzlement at Malaysia’s 1MDB

Posted by Kit in Corruption, Financial Scandals, Najib Razak on Friday, 1 April 2016

by Stephanie Bodoni/Shamim Adam

Bloomberg

March 31, 2016

Authorities in Luxembourg and Singapore are investigating transactions involving 1Malaysia Development Bhd. as the Malaysian state fund faces expanding probes into allegations of embezzlement and money laundering.

Prosecutors in Luxembourg said they started an investigation of 1MDB, as the fund is known, after finding “concrete clues” of embezzlement from companies owned by the fund via accounts in Singapore, Switzerland and Luxembourg. In response to questions about 1MDB, the Singapore central bank said it is conducting a “thorough review of various transactions as well as fund flows” through its banking system.

“The alleged facts concern in particular the amounts paid during the issuance of two bonds in May and October 2012,” Luxembourgish prosecutors said in an e-mailed statement. They will seek to “retrace the origin of four transfers during 2012 and one transfer in early 2013 for a total of several hundred million dollars, to an offshore company with an account in a bank in” Luxembourg. Read the rest of this entry »

Malaysia’s reputation at stake

Posted by Kit in Corruption, Financial Scandals, Najib Razak on Friday, 1 April 2016

The Australian

APRIL 1, 2016

Malaysian Prime Minister Najib Razak is doing neither himself nor the standing of his country any good by being so obdurate over the corruption charges that have been levelled against him. Lashing out at media (specifically Australian journalists) over reporting of the scandal and threatening members of the Malaysian Bar who have been critical of him with prosecution under draconian, colonial era sedition laws heighten concerns about his authoritarian government.

Mr Najib’s refusal to discuss, much less provide a credible explanation for, the $1 billion linked to the debt-laden sovereign wealth fund 1Malaysia Development Berhad that landed in his personal bank accounts is unhelpful. He should realise that even in countries that are major regional economic and strategic partners such as Australia — which long has been strongly linked to Kuala Lumpur through the Five Power Defence Arrangements and was closely allied with it in helping in the aftermath of the Malaysia Airlines MH370 and MH17 disasters — there is deepening concern about the fallout from the scandal. The US, too, is showing signs of dismay. Read the rest of this entry »