by Martin Jalleh

by Martin Jalleh

This entry was posted on Saturday, 23 March 2013, 9:27 pm and is filed under Martin Jalleh. You can follow any responses to this entry through RSS 2.0.

You must be logged in to post a comment.

Fusion theme by digitalnature | powered by WordPress

Entries (RSS) and Comments (RSS) ^

#1 by Jeffrey on Saturday, 23 March 2013 - 10:27 pm

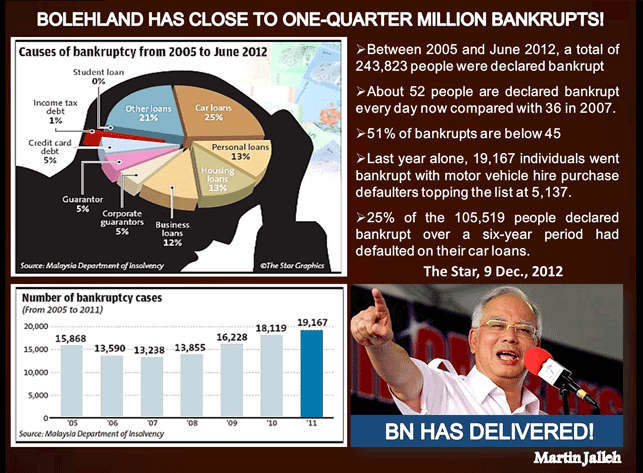

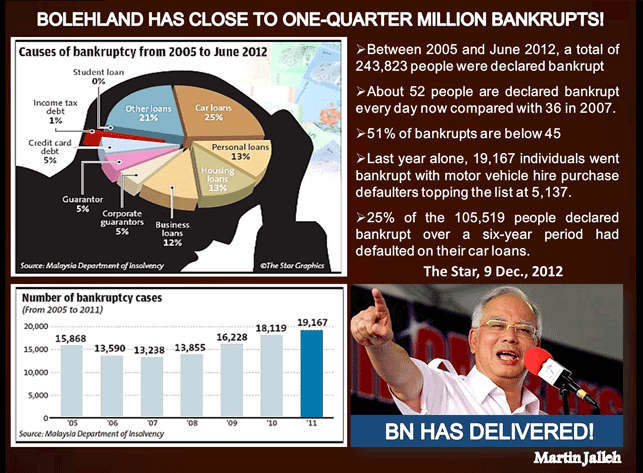

It is easier and more direct to the point to blame BN for making Malaysia go bankrupt than Malaysians getting bankrupt – unless one makes the connection between the economic mismanagement and wastage causing the devaluation of the Ringgit and the rising costs of living (which latter is incidentally quite prevalent in many other better managed and developed countries as well). Rising bankruptcy has much to do with our attitudes to spend on borrowing and poor management of personal finances. This country has about 320 shopping complexes; banks push out loans for profits and mail invitation/credit cards to 18 year olds! The youth want lifestyle and each wants to own a car acquired on easy credit. We have a credit culture here and we have high household debt paying cars and household items and other expenses by credit cards- sign first and worry about paying later as we could just pay monthly 10% of the credit card outstanding and carry on signing!

#2 by Jeffrey on Saturday, 23 March 2013 - 10:34 pm

More bankruptcies will happen when bubbles (whether credit or property bubbles burst). Worrying about inflation people keep buying properties as hedge and borrow loans from bank (pushing prices up). Bank Negara imposes a 3 loan per person restriction but they circumvent by getting proxies to use their names to buy. When Bank Negara lowers the margin of financing they jack up the purchase price (in complicity with the sellers) and the bank approving officers who close one eye as they get a commission for pushing out loan growth.

#3 by sheriff singh on Saturday, 23 March 2013 - 11:53 pm

The cost of everything has gone up including the price of cars.

The current threshold of RM 30,000 or so is too low. It should be raised to RM 100,000 as otherwise most financiers will just take the easy way out and file the borrowers for bankruptcy.

Does making a person a bankrupt solve the problem? If the borrower genuinely can’t pay he can’t pay.

Did the financiers do proper credit checks? Are the financiers themselves to blame? How does charging a defaulter a punitive default rate of interest help the defaulter? Isn’t it making the situation worse for the borrower? He can’t pay but the financiers wallops him further. Often, a big portion of the default amount owed is the interest which balloons very quickly.

So what does the Consumerism Ministry and Bank Negara want to do about it ? The bankruptcy laws must be changed to protect the consumer.

There must be a insurance scheme to protect loans taken so that borrowers are protected. Some bank credit cards are already insured but why are their credit card holders still made bankrupts?

#4 by worldpress on Sunday, 24 March 2013 - 12:45 am

Corruption politicians target billion not millions

#5 by yhsiew on Sunday, 24 March 2013 - 1:29 am

BNM has failed to come up with EFFECTIVE policies to prevent bankruptcy.

#6 by boh-liao on Sunday, 24 March 2013 - 9:06 am

UmnoB/BN oredi told us we r heading 2 BANKRUPTCY

So, “Bolehland – a nation of bankrupts” is exactly what NR n UmnoB/BN PROMISED n DELIVERED – jilaka, betul betul Janji diTEPATI,

#7 by Bigjoe on Sunday, 24 March 2013 - 2:10 pm

You really want to know how is it UMNO/BN can make these kinds of things? Here is how:

Mahathir says Anwar’s anti-NEP stance flawed. Anwar NEVER SAID his anti-NEP stance was PERFECT.. BUT Mahathirism WAS A WRECKING BALL – destroyed just as much as it made and left a trail of unjust wreckage..

#8 by ENDANGERED HORNBILL on Sunday, 24 March 2013 - 4:09 pm

In BOLEHLAND, bankruptcy is a life sentence and death sentence rolled into ONE.

Thank you BN.

BN has delivered.